Owning a house & earning rental income sounds rewarding—until taxes enter the picture. Fortunately, the Income Tax Act provides certain deductions that ease your tax liability on income from house property. One of the most fundamental of these is Section 24(a), which allows a standard deduction on the Net Annual Value (NAV) of your property.

Whether you're a salaried individual with one rented property or a real estate investor with multiple assets, understanding Section 24(a) can help you reduce your tax burden significantly—& legally.

What is Section 24 of the Income Tax Act?

Section 24 falls under the broader umbrella of “Income from House Property.” This section provides deductions from the annual value of a house property before computing the taxable income.

It has two key components:

- Section 24(a) – Standard Deduction (flat 30%)

- Section 24(b) – Deduction on interest paid on housing loan

This article focuses exclusively on Section 24(a).

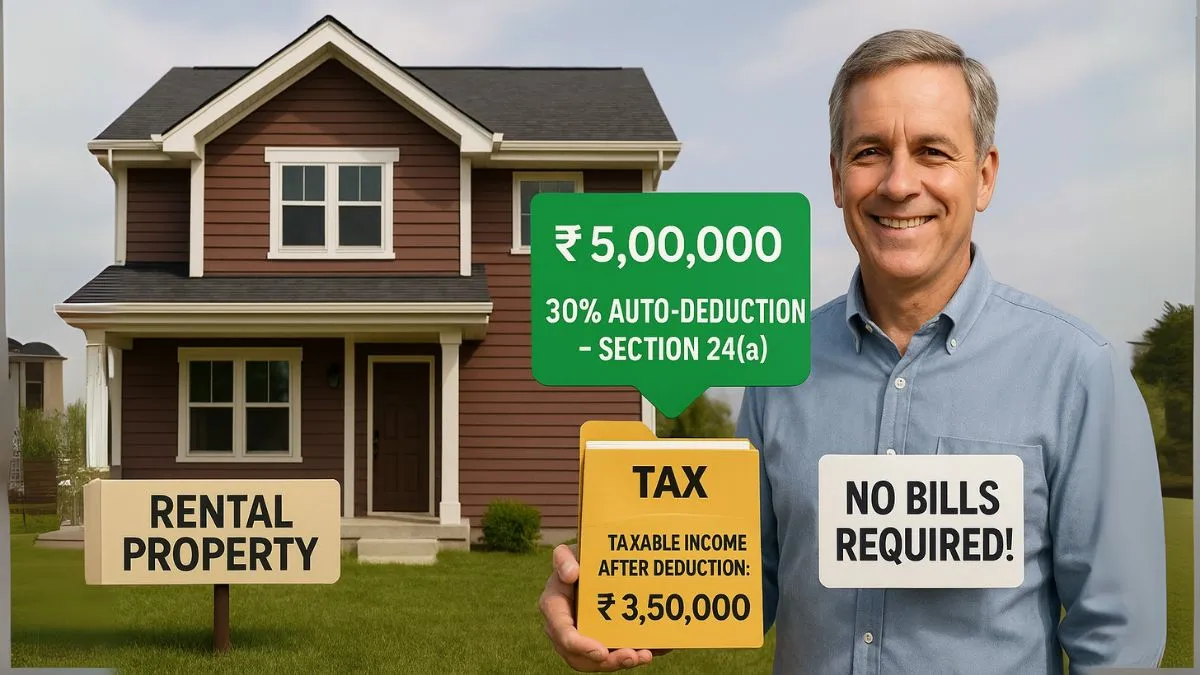

Section 24(a): 30% Standard Deduction

Under Section 24(a), the assessee is allowed a flat deduction of 30% of the Net Annual Value of the house property. This is irrespective of the actual expenses incurred on repair, maintenance, or renovation.

✅ Key Highlights:

- It applies only to let-out properties or deemed-to-be-let-out properties

- The deduction is not allowed for self-occupied houses (since NAV is zero)

- The deduction is fixed at 30%—you cannot claim more or less."

- No bills or proof of expense required

Understanding Through an Example

Let’s say you own a residential flat that is rented for ₹20,000/month:

- Annual Rent = ₹2,40,000

- Municipal Taxes paid = ₹10,000

- Net Annual Value (NAV) = ₹2,30,000

- Deduction under Section 24(a) = 30% of ₹2,30,000 = ₹69,000

- Taxable Income from House Property = ₹1,61,000

So, you save ₹69,000 from being taxed, without even submitting a single receipt.

Applicability of Section 24(a)

|

House Type |

Standard Deduction (30%) Available? |

|

Self-Occupied Property |

❌ No (NAV is zero) |

|

Let-Out Property |

✅ Yes |

|

Deemed-to-be Let-Out Property |

✅ Yes |

|

Under-construction Property |

❌ No (until completion certificate is issued) |

Important Notes:

- Municipal taxes must be paid by the owner & can be deducted before applying Section 24(a)

- Even if actual expenses are higher or lower, the deduction remains at a flat 30%

- No other repair or maintenance costs can be claimed separately under this head."

Section 24(a) vs Section 24(b)

|

Aspect |

Section 24(a) |

Section 24(b) |

|

Nature of Deduction |

Standard deduction (30%) |

Interest on housing loan |

|

Limit |

Fixed at 30% |

Up to ₹2,00,000 (self-occupied) |

|

Proof Required |

❌ No |

✅ Yes (loan statements required) |

|

Property Applicability |

Let-out & deemed let-out only |

Both self-occupied & let-out |

Frequently Asked Questions (FAQs)

Q1. Is Section 24(a) deduction available for self-occupied homes?

❌ No, since the net annual value is considered nil for self-occupied properties.

Q2. Can I claim both 24(a) & 24(b) deductions?

✅ Yes, if the property is let out or deemed to be let out.

Q3. Do I need to show bills for repair or renovation to claim 30%?

❌ No. The deduction is fixed & automatic—no documentation is required.

Q4. Can I claim Section 24(a) for commercial property?

✅ Yes, if it falls under "income from house property" & is not shown as business income.

Q5. What happens if I leave my second property vacant?

It is treated as deemed let-out, & Section 24(a) applies.

Conclusion

Section 24(a) is a simple yet powerful tax-saving tool for property owners earning rental income. The flat 30% deduction without the hassle of paperwork makes it one of the most user-friendly provisions of the Income Tax Act. But like every tax law, its true power lies in understanding its scope & limitations.

👉Are you earning rent & still paying heavy taxes? Learn how to claim a 30% tax deduction on your rental income—without any receipts! Let our experts at Callmyca.com handle your tax planning & filings so you can save more & stress less. Book your free consultation today!