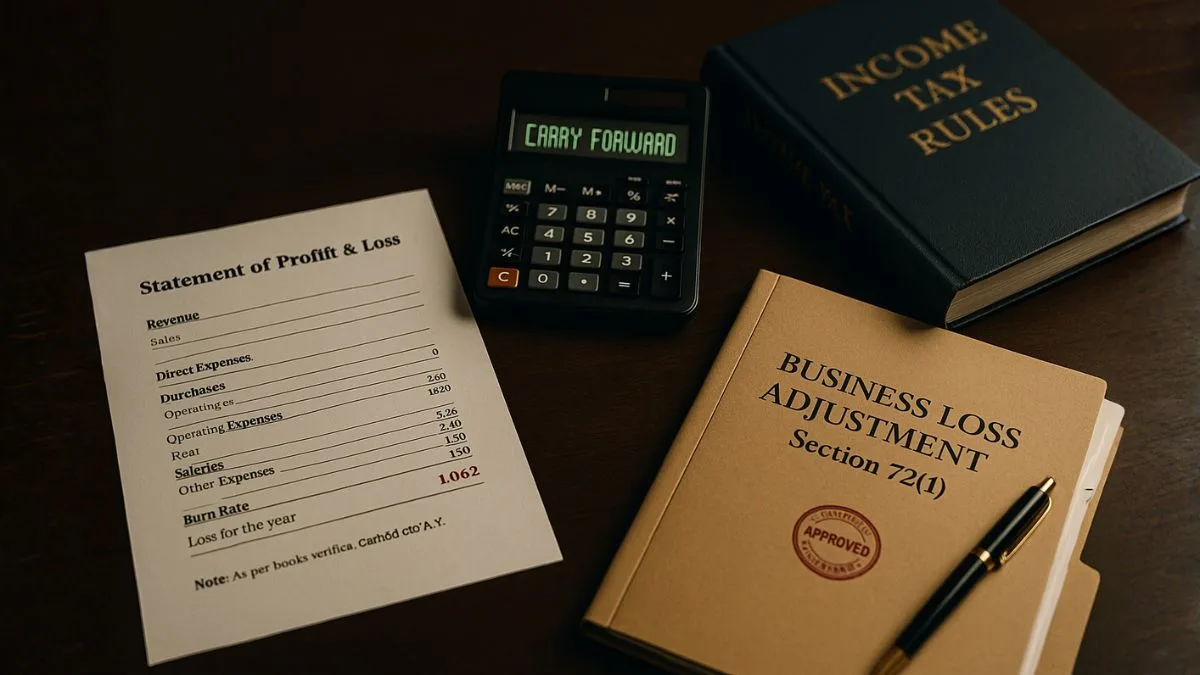

Businesses grow in cycles. Markets shift, projects fail, credit tightens, and not every year delivers profit. Tax law acknowledges this natural rhythm. Section 72(1) exists because a tax system built only around profitable years would be incomplete — it would ignore the periods where enterprises invest, struggle, restructure or rebuild.

This provision recognises that losses are an inevitable part of legitimate economic activity, & that taxation must operate on net gains over time rather than isolated annual outcomes. In doing so, it ensures that tax liability does not become punitive when business conditions are challenging.

What Section 72(1) Allows

Section 72(1) deals with the carry forward & set off of business losses (excluding speculation business losses). That distinction matters — speculation losses follow different treatment and cannot be mixed with ordinary business losses.

The rule permits:

- Loss from Business/profession [Sec 72] to be carried forward

- Losses to be set off only against profits from business/profession, not other heads of income

- Carry forward for up to eight assessment years immediately succeeding the year in which loss was incurred

- Carry forward benefit only if the return is filed within due date

This creates a balanced system — supportive yet structured.

The Set-Off Principle Explained

The law follows a sequential logic: if a taxpayer has income under “Profits and Gains of Business or Profession” in a future year, the earlier brought-forward loss can be adjusted against that income first, before applying current-year deductions. The intent is to transform losses into future economic breathing room, not an indefinite tax shelter.

This also aligns with international tax standards, where business continuity is protected while maintaining time-bound limits.

Also Read: Carry Forward of Losses in Case of Amalgamation or Merger

Practical Illustration

Example:

A manufacturing business incurs a loss of ₹18 lakh in FY 2023-24.

In FY 2025-26, the same business earns ₹12 lakh profit.

Under Section 72(1):

- The ₹18 lakh loss is eligible to be carried forward (subject to timely filing)

- In FY 2025-26, ₹12 lakh is fully set off against carried-forward loss"

- The balance ₹6 lakh loss can continue to be carried forward for the remaining period within the 8-year window

Result: no taxable business income for FY 2025-26.

This ensures genuine business hardships are not taxed in future recovery years.

Compliance Lens — What Taxpayers Must Remember

To utilise Section 72(1), conditions apply:

|

Requirement |

Purpose |

|

Business loss must be declared in a return filed within due date |

Prevents retrospective claims |

|

Loss can be set off only against business income |

Maintains category integrity |

|

Loss can be carried forward for 8 AYs |

Ensures time-bound utilisation |

|

Speculation losses excluded |

Governed under a separate regime |

This structure protects the integrity of the provision while supporting business resilience.

Distinction From Speculative Losses

While Section 72(1) covers carry forward & set off of business losses, it excludes speculation business losses.

Speculation activities have historically required closer scrutiny. They carry distinct characteristics — higher volatility, intent-based evaluation, and a different tax framework. Hence, speculative losses fall under Section 73, not Section 72.

This separation avoids blending operational losses with speculative activity, enabling clearer tax treatment.

Also Read: How Shipping Companies Are Taxed Without PAN in India

Connection to Broader Policy Thesis

Section 72(1) fits into India's broader philosophy of encouraging entrepreneurship by providing structured relief where income fluctuates.

Parallel themes exist elsewhere in tax law.

For instance, the Act allows for deductions while computing taxes for expenses relating to scientific research, including expenditure of a capital nature on scientific research, & provides for a deduction of expenses incurred on scientific research and development activities. Similar provisions support long-term investments, recognising that returns may come later.

Just as research investments need time, business losses need accommodation."

The tax system acknowledges both realities.

Modern-Era Relevance

In periods of economic transition — such as digitisation waves, supply-chain cycles, global inflation impacts, start-up scaling costs, & capital-heavy expansions — the significance of Section 72(1) increases.

It gives genuine enterprises room to recover, innovate and reinvest.

A resilient tax framework contributes directly to a resilient economy.

Key Points Summarised

- Section 72(1) governs carry forward & set off of business losses

- Applies to Loss from Business/profession [Sec 72]

- Excludes speculation business losses

- Losses can be carried forward 8 AYs

- Set-off applies only against business income

- Return must be filed on time to claim this benefit

Also Read: Relief for Business Losses You Didn't Know You Could Claim

Conclusion

Section 72(1) stands as an acknowledgement that growth is rarely linear. It offers fairness by allowing businesses to offset difficult years against prosperous ones, ensuring taxation mirrors real economic performance. When applied correctly, it supports discipline, planning, & business continuity without compromising fiscal responsibility. For enterprises seeking to navigate loss treatment, restructuring, or multi-year tax planning, professional guidance helps maximise relief while ensuring compliance.

If you would like expert support in utilising Section 72(1), preparing loss schedules, or strategically planning your business tax filings, our CA team at CallMyCA.com is equipped to assist. Connect with us to move from uncertainty to structured clarity.