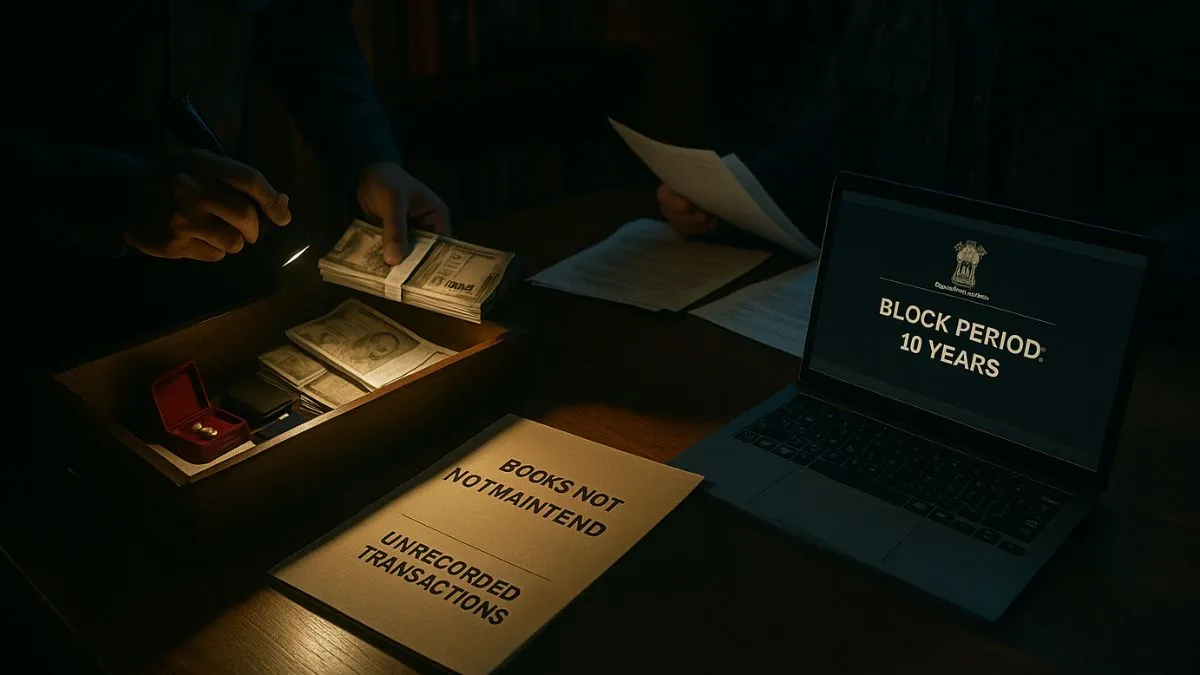

If you’ve ever read news about income-tax search cases, you might have noticed one thing: the moment a search happens, the entire taxation process changes. Normal assessments don’t apply. Instead, the law switches to a stricter mechanism that deals with hidden income, often found in the form of cash and jewellery kept in the safe, benami transactions, or unrecorded business entries.

This is where Section 158B of the Income Tax Act comes in. It defines the basic terms needed before the department can compute income in a “block period.” Without Section 158B, the entire block assessment system would collapse because definitions like “undisclosed income” form the foundation of a search case.

This section is not about tax rates or calculations but about the meaning of the words that guide the entire process. When an assessee is searched, understanding this section becomes the first step in knowing how the case will unfold.

What Section 158B Really Covers — The Core of Block Assessment

At its heart, Section 158B provides definitions related to the special procedure for block assessment. These assessments happen under Chapter XIV-B, introduced to deal with situations where income was intentionally hidden & later discovered during search and seizure actions.

The idea is simple: When the Income Tax Department conducts a search under Section 132 or a requisition under Section 132A, any assets, documents, or valuables found become potential evidence of suppressed or undisclosed income. And Section 158B tells us the meaning of terms used to categorize and tax that income.

The most important part of the section is how it defines undisclosed income. This term includes income that:

- was never recorded in books of accounts,"

- was not disclosed to the department,

- or was represented by cash, jewellery, valuable assets, or bogus documents found during the search.

If, for example, cash and jewellery found in the safe cannot be properly explained or matched with recorded entries, then under Section 158B, they are treated as undisclosed income discovered during the search. And once income falls into that category, it becomes liable for assessment under the special block assessment procedure.

Why the Tax Rate Is Different in These Cases

One of the strict elements of the block assessment system is that any undisclosed income discovered is taxed at a higher rate of 60%. This flat rate is significantly higher than normal slab rates.

The logic behind this is straightforward:

Hidden income is treated as a serious offence, and therefore, the tax system imposes a punitive rate. Section 158B doesn’t specify the rate itself but works alongside other provisions that finalize this harsh tax treatment.

So if ₹25 lakh in unexplained cash is found during a search, it doesn’t get taxed at normal slab rates. Instead, the entire amount is pulled into the block assessment & taxed at the special rate prescribed.

This discourages individuals & businesses from keeping unreported income outside the financial system.

Also Read: Procedure Where an Identical Question of Law is Pending

How Section 158B Defines “Block Period" and Why It Matters

Another definition that Section 158B provides is “block period.”

In search cases, the department doesn’t only look at the current year. It goes back several years—typically 6 to 10 years depending on the law applicable at the time.

This retrospective window helps the department assess income that remained hidden for years. Papers, diaries, loose sheets, or valuables found during a search often relate to old transactions. Without the definition of “block period,” the assessing officer would have no legal basis to reopen earlier years for the purpose of evaluating hidden income.

Section 158B gives the officer this authority by defining the time span that will be assessed.

Cash, Jewellery, and Valuables — How They Become Undisclosed Income

During search operations, the most commonly found items are:

- Cash hidden at home or office

- Gold jewellery not reflected in books

- Property papers, benami agreements

- Hard drives containing parallel books

- Loose diaries with unrecorded income

Under Section 158B, these items are classified as undisclosed income if they are not properly recorded or explained. For example:

If jewellery worth ₹10 lakh is found in a safe & the assessee cannot show proper invoices or evidence of inheritance, it would be treated as undisclosed income for the block period.

This definition is extremely powerful because the moment an asset qualifies as undisclosed, it automatically enters the block assessment computation.

Why Section 158B Works Like the Foundation of Search-Related Assessments

The entire block assessment system—from calculation to tax rate—depends on how terms in Section 158B are defined.

If “undisclosed income” is interpreted broadly, the scope of tax expands.

If interpreted narrowly, only specific items get taxed.

Section 158B plays a major role in ensuring that:

- loopholes are minimized,

- hidden wealth is brought to tax, and

- the assessing officer has clarity on what can be included in the block period assessment.

For taxpayers, understanding these definitions helps in preparing documentation & handling scrutiny post-search.

Practical Examples to Understand Section 158B Better

Example 1 — Cash Found in Safe

Cash of ₹12 lakh is found during a search. The assessee claims it is from past savings but has no withdrawals or proof.

Under Section 158B, this becomes undisclosed income.

Example 2 — Jewellery Without Invoices

Gold jewellery of 800 grams is found. The person has no bills & no proof of inheritance."

This jewellery is treated as undisclosed income discovered during the search.

Also Read: MLI Full Form (Multilateral Instrument): A Global Step Against Tax Avoidance

Example 3 — Unrecorded Sales Diary

A diary showing unaccounted cash sales of ₹50 lakh is found.

Even though the diary is just a notebook, it represents income not recorded in the books, making it taxable under the block period.

These real-world scenarios explain why definitions under Section 158B are so crucial.

Why Section 158B Matters for Businesses and Individuals

Many taxpayers believe search laws apply only to large businesses, but even individuals can fall under block assessment if they hold unreported assets. Section 158B ensures that whenever a search occurs, the law has a clear and consistent way to define hidden income.

It brings certainty, clarity, & structure to the assessment process.

Conclusion — Section 158B Is the Backbone of Block Assessment

Section 158B of the Income Tax Act might look like a simple definition clause, but in practice, it determines the fate of a search case. It tells us what counts as undisclosed income, how cash & jewellery found in the safe should be treated, how the block period is defined, and why such income may be taxed at a higher rate of 60%.

For anyone facing a search or dealing with compliance for high-risk assessments, understanding Section 158B is essential.

If you want professional assistance in handling tax notices, search-related queries, or block assessments, our experts at CallMyCA.com can help you navigate the entire process smoothly.