If you receive a fixed monthly amount from your employer, you’re probably earning what the Income Tax Act calls salaried income. Salary is considered “the first head of income” under Section 14 of the Income Tax Act, 1961. But what exactly counts as salaried income? And how is it taxed?

Whether you're a fresher in your first job or a working professional filing your 5th ITR, understanding this head of income is key to saving taxes & filing correctly.

What is Salaried Income?

Salaried income refers to the money you receive from your employer in exchange for services rendered. This includes not just your basic pay, but also allowances, bonuses, commissions, perquisites, and more.

The Income Tax Act defines salary income as anything received from an employer-employee relationship, & that’s what makes it the first head of income.

Components of Salaried Income

Your salary may look like one number in your bank account, but for income tax, it’s broken down into several components:

- Basic Salary – The fixed part of your CTC, fully taxable

- House Rent Allowance (HRA) – Partially exempt if you pay rent

- Dearness Allowance (DA) – Fully taxable

- Leave Travel Allowance (LTA) – Exempt on actual travel expenses (subject to rules)

- Bonus/Commission – Fully taxable

- Special Allowance – Fully taxable

- Perquisites (Perks) – Value of car, rent-free accommodation, ESOPs, etc.

All these together form your gross salaried income.

How is Salary Income Taxed?

Salaried income is taxed under the head ‘Income from Salaries’, and is added to your total income for the financial year. From this, you can claim:

- Standard Deduction of ₹50,000

- HRA exemption (if you pay rent)

- Leave Travel Concession (on actual eligible journeys)

- Professional Tax (if applicable)

After deducting these from gross salary, you arrive at taxable salary income.

Then, the applicable income tax slab is applied, either under:

- Old Tax Regime (with deductions like 80C, 80D, etc.)

- New Tax Regime (lower rates, fewer deductions)

Also Read: A Salary Perk That Doubles as a Tax Shield

Which ITR Form to Use for Salaried Income?

If salary is your only income, or you also have income from one house property & bank interest, then:

- ITR-1 (Sahaj) is your go-to form (income up to ₹50 lakh)

- If your income exceeds ₹50 lakh or you have capital gains: Use ITR-2

👉 Always check Form 16 to match the values while filing your return."

Documents Needed to File ITR for Salaried Income

Here’s what you need before filing:

- Form 16 from your employer (Part A & Part B)

- Form 26AS (Tax Credit Statement)

- AIS/TIS from the income tax portal

- Rent Receipts, if claiming HRA

- Investment proofs for deductions (under the old regime)

- Bank interest certificate (for 80TTA or 80TTB)

Tax Saving Options for Salaried Individuals (Old Regime)

You can claim deductions under:

- Section 80C – Investments in LIC, PPF, ELSS, etc. (up to ₹1.5 lakh)

- Section 80D – Medical insurance premiums

- Section 80E – Education loan interest

- Section 80TTA/TTB – Savings account interest

These can lower your taxable income substantially if you choose the old tax regime.

Benefits of Being a Salaried Taxpayer

- Automatic TDS Deduction – The Employer deducts & deposits your tax

- Form 16 Simplifies Filing – Contains all income and deduction info

- Access to Standard Deduction – ₹50,000 without any documents

- Loan Eligibility – Salary slips and Form 16 are widely accepted

Also Read: How ‘Actual Rent Received’ Affects Your Taxable Income

Common Mistakes to Avoid

- Forgetting to report income from previous jobs

- Not disclosing interest income from savings accounts or FDs

- Claiming HRA without proper rent receipts

- Skipping the new regime vs the old regime comparison"

- Filing an incorrect ITR form

Important Due Dates

- ITR Filing for Salaried Individuals (AY 2025–26): 31st July 2025

- Revised Return (if needed): Within 3 months from the end of the relevant assessment year

Missing deadlines may result in late fees under Section 234F and interest under Section 234A.

Final Thoughts

To sum up, salaried income is the first head of income as per Indian tax laws & applies to lakhs of working professionals. Filing your ITR correctly as a salaried employee is easy, especially if you have Form 16 and other documents in place.

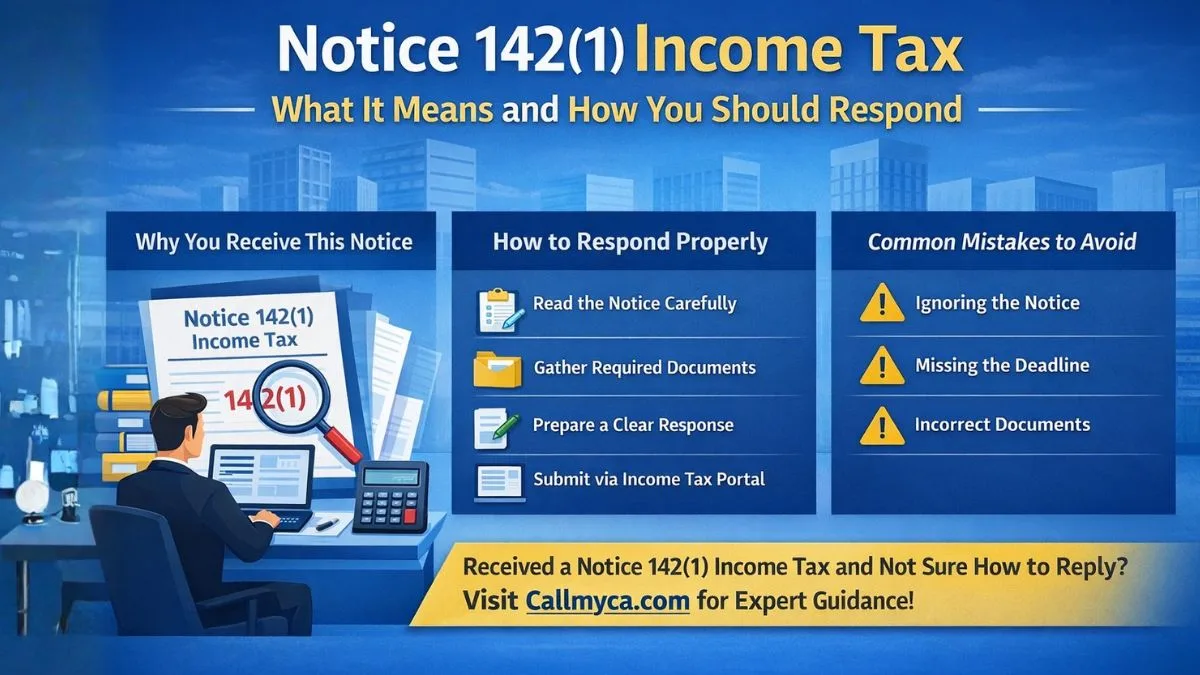

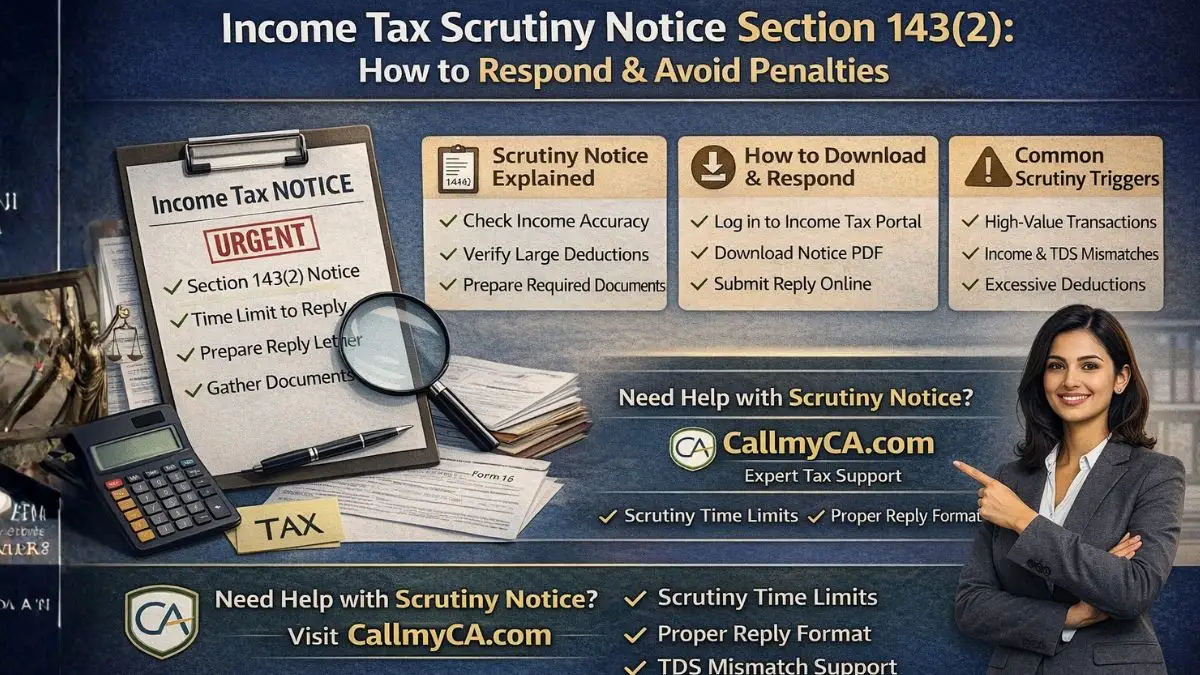

But remember, a mistake in declaring or under-reporting salary income can trigger tax notices. So, double-check everything or take help from professionals if needed.

Need help filing your salaried ITR smartly? Our team at Callmyca.com will get it done—fast, accurate, and stress-free. Book now & stay worry-free.