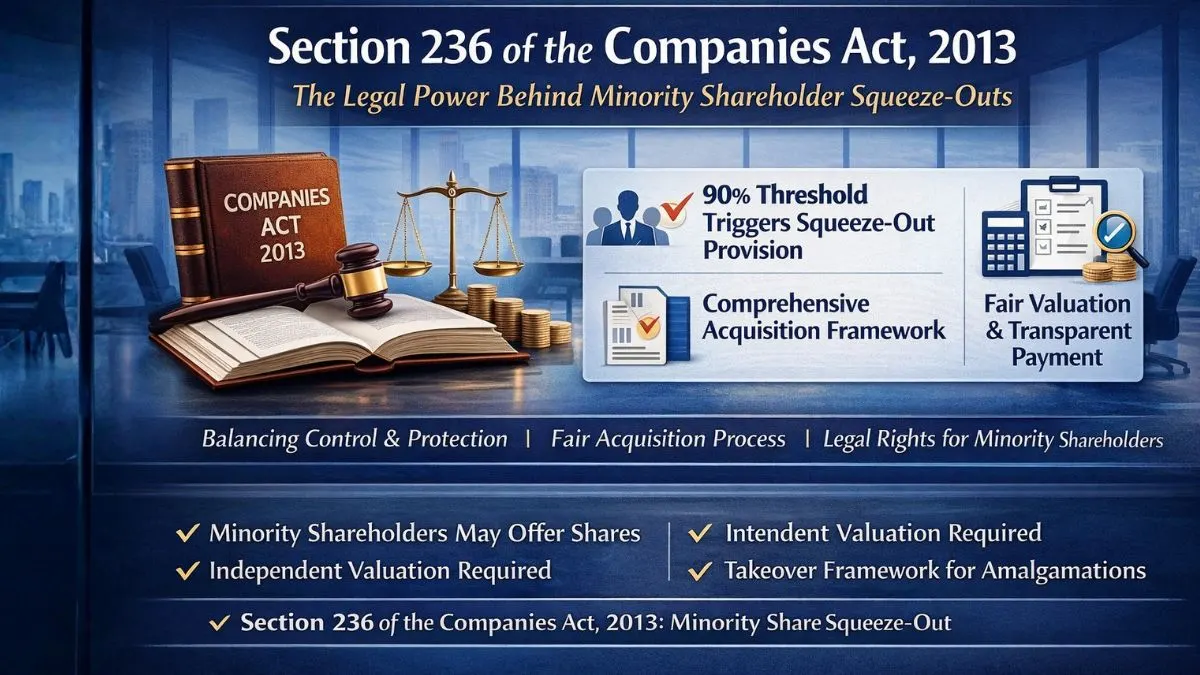

Section 236 of the Companies Act, 2013: The Legal Power Behind Minority Shareholder Squeeze-Outs

When a company grows, power slowly starts concentrating.

At first, everyone has a voice.

Everyone feels involved.

Everyone matters.

But over time, one shareholder—usually the promoter or a major investor—starts gaining more control.

And once someone reaches the top, the big question becomes:

Will this power be used responsibly? Or will it be misused?

This is where the Companies Act, 2013, steps in.

And within it, Section 236 of the Companies Act, 2013, plays a very important role.

It exists to make sure that control does not turn into pressure and success does not turn into injustice.

What Is Section 236 of the Companies Act, 2013?

Section 236 provides a mechanism for a majority shareholder (holding 90% or more) to acquire the remaining minority equity shares, often called a "squeeze-out" provision.

In practical terms, this means:

When any shareholder holding shares to the extent of 90% of the company reaches that level, the law gives them the right to buy out the rest.

But not forcefully.

Not secretly.

Not unfairly.

Instead, through a comprehensive legal framework for the compulsory acquisition of minority shareholding.

This framework makes sure that the purchase of minority shareholding happens in a proper, transparent, and legally protected way.

Why Was Section 236 Introduced?

Before the Companies Act, 2013, things were very different.

Majority shareholders felt stuck.

Minority shareholders felt unsafe.

Disputes were common.

Court cases dragged on for years.

Everyone lost time. Everyone lost money.

Section 236 was introduced to bring clarity.

It was meant to:

-

Reduce unnecessary conflicts

-

Protect small investors

-

Help companies restructure smoothly

-

Prevent misuse of power

In short, it was introduced to bring balance.

Who Can Start the Process Under Section 236?

The rule is simple.

Any shareholder holding shares to the extent of 90% can use this provision.

This includes:

-

Promoters

-

Holding companies

-

Strategic buyers

-

Investors who gained control through acquisition

Once this level is crossed, the law recognizes their right—but only if they follow the rules.

Power is allowed. Abuse is not.

Minority Shareholders Are Not Helpless

Many people assume that Section 236 only benefits big shareholders.

That’s not true.

Under this law, minority shareholders of the company may offer to the majority shareholders to purchase their shares.

So even minority investors can take initiative.

They don’t have to wait forever.

They can:

-

Ask for an exit

-

Demand fair value

-

Trigger compulsory acquisition

This protects them from being trapped in a company where they no longer matter.

What Does “Squeeze-Out” Really Mean?

A squeeze-out means the majority shareholder buying out the remaining investors.

Earlier, this often happened informally.

Sometimes with pressure.

Sometimes with unfair pricing.

Sometimes without transparency.

Now, under Section 236, it is regulated.

The law insists on:

-

Independent valuation

-

Fair price discovery

-

Full disclosure

-

Proper payment

So the process becomes professional, not personal.

Valuation: The Most Sensitive Part

Let’s be honest.

Money is where most disputes happen.

That’s why Section 236 focuses heavily on valuation.

The price must be fixed by a registered valuer based on:

-

Company financials

-

Market value

-

Profit potential

-

Similar transactions

This protects minority shareholders from being underpaid.

How Payment and Share Transfer Work

Section 236 also protects shareholders through clear procedures.

It says:

-

Money must be paid on time

-

Shares are transferred only after payment

-

If someone cannot be traced, funds are kept separately

This avoids manipulation and unnecessary delay.

Takeover of Minority Shareholders in Cases of Amalgamation

This section becomes especially important during mergers.

After two companies merge, some shareholders lose relevance.

Their presence may:

-

Slow down decisions

-

Create confusion

-

Affect governance

In such situations, takeover of minority shareholders in cases of amalgamation becomes necessary.

Section 236 allows companies to clean up ownership after mergers and move forward peacefully.

Why Section 236 Matters for India’s Corporate System

This provision shows maturity in Indian corporate law.

It understands that:

-

Big investors need flexibility

-

Small investors deserve protection

-

Companies need stability

It brings Indian law closer to global standards.

Common Myths About Section 236

Some people think this section allows forced takeovers anytime.

That’s wrong.

The law requires:

-

A strict 90% holding

-

Independent valuation

-

Exit rights

-

Regulatory supervision

It is not a weapon. It is a framework.

Where Is Section 236 Commonly Used?

You will usually see this provision in situations like

-

Promoter stake crossing 90%

-

Group restructuring

-

Post-merger consolidation

-

Strategic buyouts

-

Delisting-type scenarios

In all these cases, it brings legal certainty.

Advice for Minority Shareholders

If you are a minority investor, don’t ignore this process.

You should:

-

Read valuation reports carefully

-

Take expert advice

-

Track payment timelines

-

Know your legal rights

Awareness is your best defense.

Risks for Majority Shareholders

For majority shareholders, shortcuts are risky.

Ignoring procedures can lead to:

-

Court cases

-

Regulatory trouble

-

Delays

-

Loss of credibility

Following the law saves time in the long run.

Final Thoughts: True Power Is Balanced Power

Section 236 of the Companies Act, 2013, is not about removing minorities.

It is about creating fairness.

It allows business leaders to simplify ownership.

At the same time, it ensures that minority investors exit with dignity, security, and proper compensation.

That balance is what makes modern corporate governance work.

Need Professional Help?

Planning a minority buyout, promoter restructuring, or amalgamation?

Get expert legal and compliance support from professionals at Callmyca.com and execute your transaction with confidence.