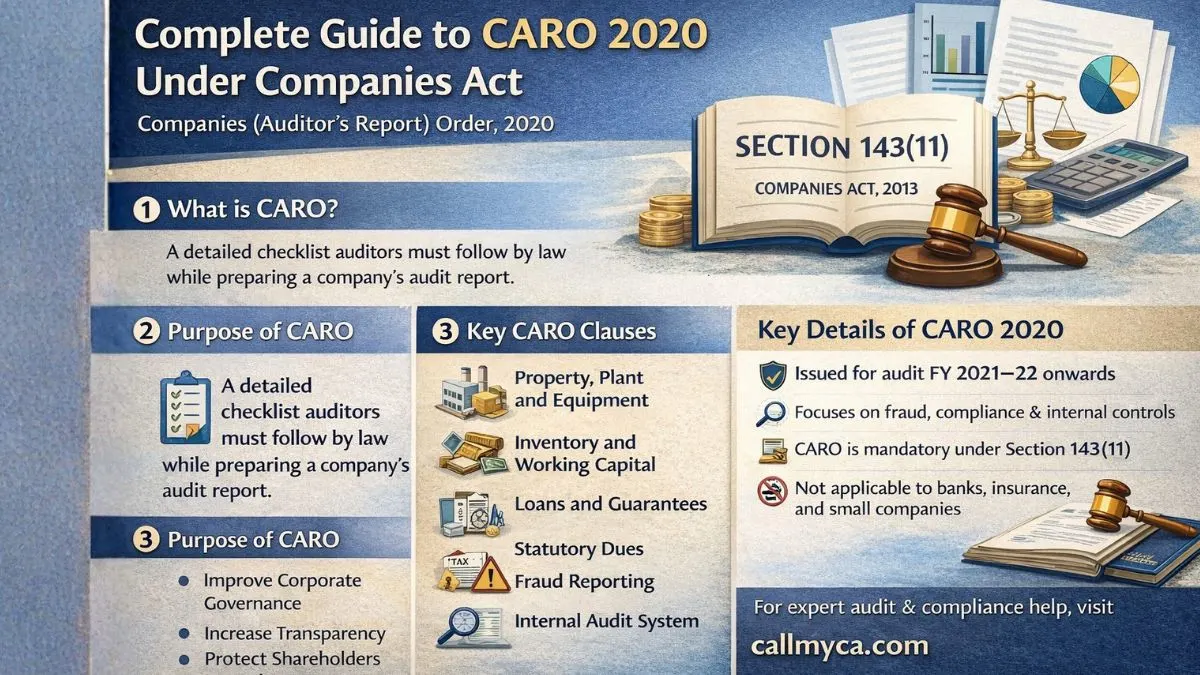

CARO Section: Complete Guide to CARO 2020 Under Companies Act

If you have ever read a company’s audit report and wondered why the auditor suddenly starts giving a long, checklist-style commentary on loans, inventories, statutory dues, frauds, and internal controls—you were looking at the CARO section.

Many business owners and directors sign audit reports every year without really understanding:

-

What CARO is

-

Why auditors ask for so much data

-

How it affects compliance and risk

But the truth is, the CARO section plays a major role in shaping how banks, investors, and regulators view your company.

What Is the CARO Section?

The CARO section refers to the reporting requirements under the Companies (Auditor’s Report) Order, 2020 (CARO 2020) in India.

In simple terms, CARO is a detailed questionnaire that the law requires auditors to follow while issuing an audit report.

It is mandatory under:

👉 Section 143(11) of the Companies Act, 2013

So when an auditor signs your report, they are not just checking numbers.

They are also making specific legal statements under CARO.

CARO Full Form and Legal Basis

The CARO full form is

Companies Auditor Report Order (CARO)

Its legal authority comes from:

-

Section 143(11) of the Companies Act, 2013

-

Issued by the Central Government

-

Mandatory for applicable companies

So CARO is not optional.

It is not based on an auditor’s personal choice.

It is the law.

What Is CARO 2020?

CARO 2020 is the latest version of the Companies Auditor Report Order.

It replaced CARO 2016 and significantly expanded reporting requirements.

Key features of CARO 2020:

-

Issued in 2020

-

Applicable from FY 2021–22 onwards

-

Strong focus on fraud and internal controls

-

More detailed compliance reporting

-

New and strengthened clauses

In simple words, CARO 2020 made audits more strict and more transparent.

Why Does the CARO Section Exist?

The purpose of CARO is very practical:

-

Improve corporate governance

-

Increase transparency

-

Detect early warning signals

-

Protect shareholders and lenders

-

Reduce manipulation in accounts

Think of CARO as a health report of your company—not just profit and loss.

Is CARO Applicable to All Companies?

This is where confusion usually starts.

General Rule

CARO applies to:

-

Private limited companies

-

Public limited companies

-

Listed companies

-

Unlisted companies

Unless specifically exempted.

Companies Exempt from CARO 2020

CARO 2020 does not apply to:

-

Banking companies

-

Insurance companies

-

Section 8 companies

-

One Person Companies (OPC)

-

Small companies

Some private limited companies are also exempt if they meet all conditions, such as

-

Paid-up capital reserves within limits

-

Borrowings below threshold

-

No public deposits

If even one condition fails, CARO becomes applicable.

CARO Applicability for FY 2024–25

A very common search is

CARO applicability for FY 2024-25

The position is clear:

-

CARO 2020 continues

-

No new order yet

-

The same clauses apply

So if CARO applied earlier, it still applies now.

Where Does CARO Appear in the Audit Report?

The CARO section appears as a separate annexure, usually titled

“Annexure A to the Independent Auditor’s Report”

It contains clause-wise factual reporting—not opinions.

1. Property, Plant and Equipment

Auditor verifies:

-

Fixed asset records

-

Physical verification

-

Title deeds in company name

Any mismatch here raises serious questions.

2. Inventory and Working Capital

Auditor checks:

-

Physical verification

-

Frequency

-

Discrepancies

For companies with bank limits, this is extremely important.

3. Loans, Advances and Guarantees

Auditor reports on:

-

Loans to related parties

-

Fairness of terms

-

Regular repayments

This clause exposes fund diversion and round-tripping.

4. Compliance with Sections 185 and 186

The auditor checks compliance with loan and guarantee rules.

Non-compliance can lead to personal penalties for directors.

5. Statutory Dues

One of the most sensitive clauses.

Includes:

-

GST

-

PF/ESI

-

Income tax

-

TDS

-

Professional tax

Any undisputed dues pending for over six months are reported.

6. Fraud Reporting

Under CARO 2020, fraud reporting is strict.

The auditor must state:

-

Whether fraud was noticed

-

Nature and amount

-

Whether reported to authorities

This has changed how companies manage controls.

7. Internal Audit System

Auditor comments on:

-

Existence of internal audit

-

Whether it suits business size

Even small companies are expected to have basic systems now.

8. Cash Losses

Auditor reports whether the company suffered cash losses in:

-

Current year

-

Previous year

This signals financial stress.

9. Ability to Meet Liabilities

The auditor assesses whether the company can meet liabilities within one year.

This is a risk indicator for lenders and investors.

Why Directors Should Take CARO Seriously

Many directors think:

“CARO is auditor ka kaam.”

That is risky thinking.

Because CARO:

-

Becomes public record

-

Is read by banks and regulators

-

Can trigger inspections

-

Affects funding and valuation

-

Reflects governance quality

A weak CARO report can cost you credibility.

Common Mistakes Under CARO

From real-life cases:

-

No loan documentation

-

Ignored statutory dues

-

Property not in company name

-

Poor inventory records

-

No internal audit

These issues hurt long-term stability.

How to Prepare for CARO Audit

Simple steps that help:

-

Maintain asset register

-

Reconcile taxes monthly

-

Document related-party deals

-

Verify title deeds

-

Strengthen controls

Good preparation = fewer surprises.

Final Thoughts on CARO Section

To summarize:

-

CARO section follows Companies (Auditor’s Report) Order, 2020

-

Issued under Section 143(11)

-

Applicable from FY 2021–22 onwards

-

Applies unless exempted

-

Ensures transparency and governance

CARO is not just a compliance formality.

It is a mirror that reflects how clean, disciplined, and well-managed your company is.

If you need help with:

-

CARO applicability

-

Audit preparation

-

Fixing compliance gaps

-

Improving governance

You can always explore callmyca.com—because a clean CARO report is not luck.