CSR Section 135 Explained Simply (Applicability, Calculation & Rules)

If you are a company director, CFO, or compliance professional, chances are you’ve searched CSR section 135 at least once—usually when your auditor casually asks, “CSR applicable hai na?”

That one question can trigger panic.

Is CSR mandatory for your company?

How much do you actually need to spend?

What counts as CSR activity?

What happens if you don’t spend the full amount?

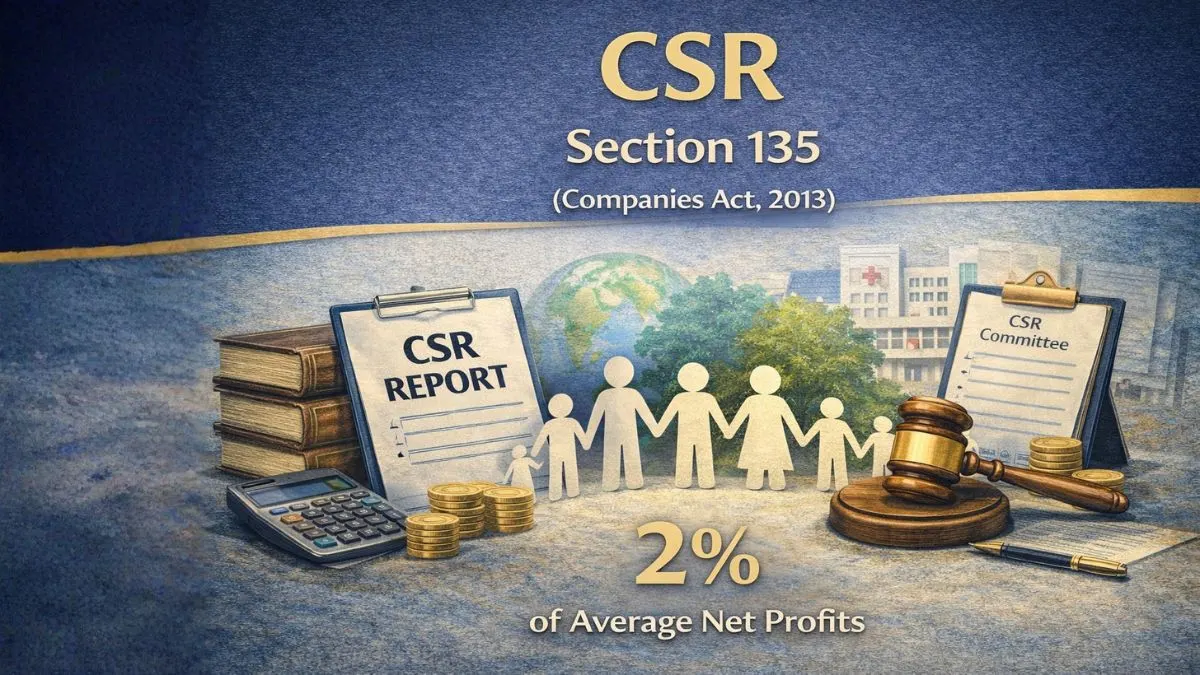

What Is CSR Under Section 135?

Section 135 of the Companies Act 2013 introduced the concept of Corporate Social Responsibility (CSR) as a mandatory legal obligation for certain companies in India.

In simple words:

Large companies must spend a portion of their profits on social welfare activities like education, healthcare, environmental protection, and poverty alleviation.

India became the first country in the world to legally mandate CSR spending.

CSR Compliance Under Section 135 of the Companies Act

CSR compliance under Section 135 of the Companies Act is not optional charity. It is a statutory responsibility.

Once applicable, a company must:

- Identify CSR activities

- Allocate funds

- Spend the prescribed amount

- Disclose it in reports

- Follow CSR rules strictly

Non-compliance now attracts penalties, not just explanations.

Section 135 of Companies Act 2013 – Applicability

The most important question is applicability.

Section 135 of the Companies Act, 2013, applicability depends on whether a company meets any one of the following thresholds during the immediately preceding financial year:

CSR Applicability Criteria

CSR applies if a company has:

- Net worth of ₹500 crore or more, OR

- Turnover of ₹1,000 crore or more, OR

- Net profit of ₹5 crore or more

Even meeting one condition makes CSR mandatory.

“Every Company Having Net Worth of Five Hundred Crore or More”

This line comes directly from Section 135(1) of the Companies Act, 2013.

Many companies assume CSR applies only to very large corporations. That’s not true.

A profitable mid-size company with:

- Net profit above ₹5 crore

can also fall under CSR.

What Is the CSR Spending Requirement?

Once applicable, the company must spend:

👉 2% of its average net profits

Yes, the limit of CSR expenditure has been decreased to 2%—and it is mandatory, not advisory.

This 2% rule is the backbone of CSR law.

CSR Calculation as per Section 135

One of the most confusing areas is CSR calculation as per section 135.

Let’s break it down.

Step 1: Calculate Average Net Profits

- Take net profits of last three financial years

- Calculate the average

Step 2: Apply 2%

- CSR amount = 2% of average net profit

CSR Calculation Example

Net profits:

- FY 2022-23: ₹8 crore

- FY 2023-24: ₹6 crore

- FY 2024-25: ₹10 crore

Average net profit = ₹8 crore

CSR obligation = 2% of ₹8 crore = ₹16 lakh

Net Profit as per Section 135—What Does It Mean?

This is where many companies make mistakes.

Net profit as per section 135 is not the same as:

- Income tax profit

- Book profit for MAT

It is calculated as per Section 198 of the Companies Act, with adjustments.

Certain items are excluded, such as:

- Capital profits

- Revaluation gains

- Foreign branch profits

Always calculate CSR profit carefully.

Section 135(1) of Companies Act, 2013 – CSR Committee

Section 135(1) of the Companies Act, 2013, also mandates the formation of a CSR Committee.

CSR Committee Requirements

- Minimum 3 directors

- At least 1 independent director

- For smaller companies, exemptions may apply

The committee:

- Formulates CSR policy

- Recommends expenditure

- Monitors implementation

CSR Rules—What Activities Qualify?

The CSR rules specify what counts as a valid CSR.

Allowed activities include:

- Education and skill development

- Healthcare and sanitation

- Poverty alleviation

- Environmental sustainability

- Rural development

- Women's empowerment

CSR cannot be:

- Normal business activity

- Political donation

- Personal benefit to employees

- Marketing or brand promotion

Section 135(5) of Companies Act, 2013 – Mandatory Spending

Section 135(5) of the Companies Act, 2013, makes CSR spending mandatory.

If a company:

- Fails to spend the required amount

Then:

- The unspent amount must be transferred

- To a specified fund or CSR account

- Within prescribed timelines

“No explanation” is no longer acceptable.

Unspent CSR Amount—What Happens?

There are two scenarios:

1. Ongoing Projects

- Transfer unspent amount to a special CSR account

- Spend within 3 years

2. Non-Ongoing Projects

- Transfer amount to government-specified funds

- Within 6 months

This change strengthened enforcement.

Section 135 of Companies Act 2013 Amendment 2022

Section 135 of the Companies Act, 2013 amendment 2022, made CSR stricter.

Key changes:

- Monetary penalties replaced imprisonment

- Mandatory transfer of unspent CSR

- Clear reporting formats

- Increased MCA scrutiny

CSR is now actively monitored, not symbolic.

Penalty for Non-Compliance With CSR

If CSR provisions are violated:

- The company can be fined

- Officers in default can also be fined

- The amount depends on default nature

CSR is now a compliance obligation, not just reputation management.

CSR Reporting and Disclosure

Companies must disclose:

- CSR policy

- CSR committee details

- Amount required vs spent

- Ongoing projects

- Unspent amounts

These disclosures are part of:

- Board’s Report

- MCA filings

CSR Section 135 PDF – Why People Search It

Many people search Section 135 of the Companies Act, 2013 pdf because:

- CSR provisions are detailed

- Amendments keep changing

- Auditors demand exact wording

But understanding the concept is more important than memorizing the section.

Common CSR Mistakes Companies Make

From real-world experience:

- Assuming CSR applies only to listed companies

- Incorrect profit calculation

- Treating CSR as donation

- Spending on ineligible activities

- Ignoring unspent amount rules

These mistakes often result in MCA notices.

Is CSR Applicable Forever Once Triggered?

Not necessarily.

CSR applicability is checked every year.

If a company does not meet thresholds for three consecutive years, CSR obligations may cease.

But past obligations must still be complied with.

CSR Is Not Just Spending—It’s Governance

CSR under Section 135 is about:

- Accountability

- Transparency

- Social responsibility

- Corporate governance

That’s why it sits inside the Companies Act, not a charity law.

Practical Advice for Companies

If CSR applies to your company:

- Assess applicability every year

- Calculate net profit correctly

- Form CSR committee timely

- Choose eligible projects only

- Maintain documentation

- Track spending quarterly

CSR planning should start early, not at year-end.

Final Thoughts: Why CSR Section 135 Matters

CSR Section 135 changed how Indian companies view social responsibility.

It is no longer:

- Optional

- PR-driven

- Discretionary

It is:

- Mandatory

- Structured

- Enforceable

Understanding Section 135 of the Companies Act 2013, its applicability, calculation, amendments, and rules can save companies from penalties and reputational damage.

Need expert help with CSR compliance, calculation, or MCA filings?

Visit callmyca.com for practical guidance on corporate law, CSR, and compliance.