Debentures Section in Companies Act 2013

If you have ever explored corporate fundraising beyond equity, you have probably searched the debentures section in the Companies Act 2013. Usually, this search comes from founders, finance heads, or investors who want to understand how companies legally raise debt without giving away ownership.

Debentures are powerful instruments. They allow companies to raise funds, maintain control, and structure repayments smartly. But they are also tightly regulated under company law.

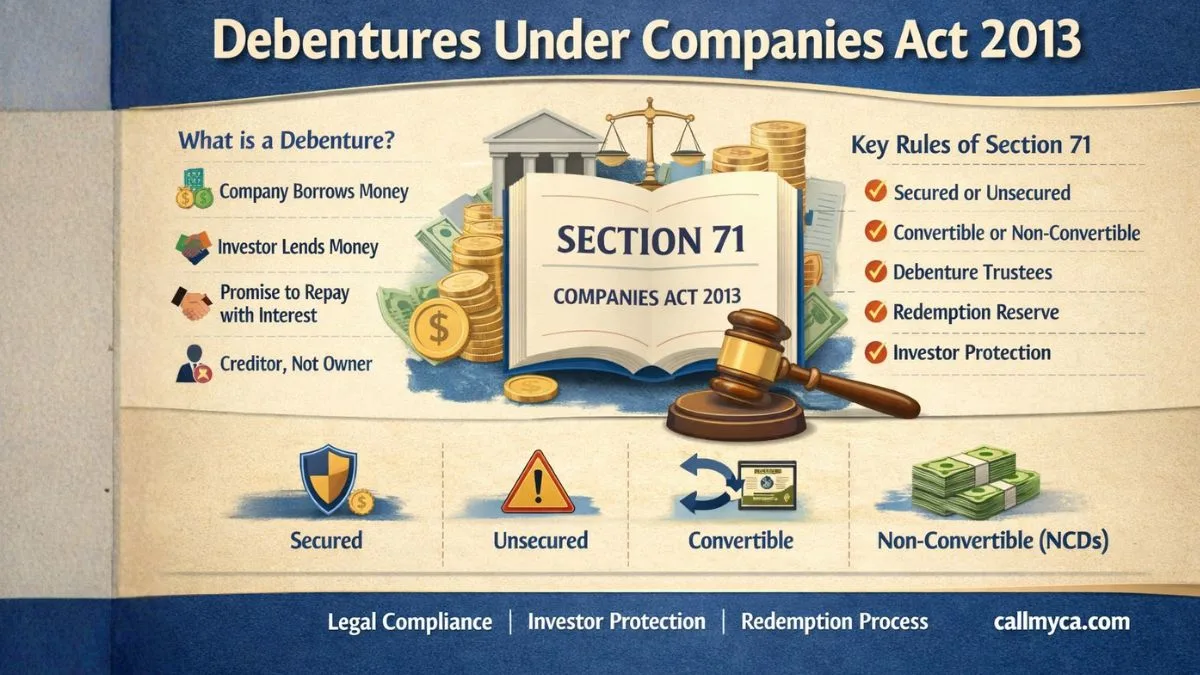

What Is a Debenture?

A debenture is an instrument of indebtedness issued by companies.

In simple words:

- The company borrows money

- The investor lends money

- The company promises to repay

- With interest

- As per agreed terms

Unlike shares:

- Debenture holders are creditors, not owners

- They do not get voting rights

- They get fixed returns

Debenture Section in Company Law—Where Is It Covered?

The debenture section in company law is primarily covered under:

👉 Section 71 of Companies Act, 2013

This section governs:

- Issue of debentures

- Conversion rules

- Security creation

- Appointment of trustees

- Redemption requirements

- Rights of debenture holders

In conclusion, Section 71 is the spine of debenture law in India.

Section 71 of the Companies Act, 2013, provides the legal framework for the issue of debentures.

It provides:

- Protection to investors

- Financial discipline

- Transparency in borrowing

- Companies cannot issue debentures arbitrarily. The section clearly provides the terms and conditions under which debentures can be issued.

Provision for Issue of Debentures as per Companies Act, 2013

The provision for the issue of debentures as per the Companies Act, 2013, includes the following key rules:

- Debentures may be secured or unsecured

- Convertible or non-convertible

- Redeemable only (no perpetual debentures)

- Must comply with prescribed conditions

The company’s Articles of Association must also permit the issuance of debentures.

Types of Debentures Under Companies Act

Debentures can broadly be classified as:

1. Secured Debentures

- Backed by company assets

- Charge created on property

- Offer higher investor safety

2. Unsecured Debentures

- No security

- Higher risk

- Higher interest usually

3. Convertible Debentures

- Can be converted into shares

- Either fully or partly

- Subject to strict approval rules

4. Non-Convertible Debentures (NCDs)

- Pure debt instruments

- Redeemed in cash

- Very common in corporate borrowing

Section 71(1) of Companies Act, 2013 – Basic Permission

Section 71(1) of the Companies Act, 2013, allows a company to issue debentures:

- With an option to convert

- Either wholly or partly

- Into shares

But conversion is not automatic.

Section 71(4) of Companies Act, 2013 – Special Resolution Requirement

One of the most important sections is section 71 4 of the Companies Act, 2013.

It says:

"If debentures are convertible into shares, a special resolution must be passed in a general meeting."

This is to safeguard the interests of shareholders from unexpected dilution.

No special resolution = no conversion.

Debenture Trustees – Mandatory Safeguard

When debentures are issued to the public or a large group, the law mandates protection.

Under Section 71, companies must:

- Appoint debenture trustees

- Execute a debenture trust deed

- Safeguard investor interests

Trustees act as watchdogs on behalf of debenture holders.

Rights of Debenture Holders Companies Act, 2013

The rights of debenture holders under the Companies Act, 2013, include:

- Right to receive interest

- Right to redemption

- Right to security enforcement

- Right to approach tribunal in default

- Right to be represented by trustees

Debenture holders enjoy strong legal protection.

Debenture Redemption Reserve Companies Act, 2013

One of the most misunderstood concepts is the debenture redemption reserve companies act of 2013.

A Debenture Redemption Reserve (DRR) is:

- A reserve created out of profits

- To ensure funds are available for repayment

Although DRR requirements have been relaxed for certain companies, they still apply in many cases.

The concept is very simple:

👉 Do not borrow money if you are not able to repay it.

Procedure for Redemption of Debentures Under Companies Act, 2013

The procedure for redemption of debentures under the Companies Act, 2013, is as follows:

- Ensure sufficient funds or DRR

- Pass board resolutions

- Pay principal and interest

- Remove charge from ROC

- Update statutory records

The redemption of debentures has to be carried out as per the terms and conditions laid down in the debenture agreement.

Can Companies Issue Irredeemable Debentures?

No.

Under the Companies Act, 2013:

- Irredeemable debentures are not allowed

- All debentures are required to be redeemable

- Within a stipulated period

- This is to safeguard the interests of investors against the indefinite locking up of funds.

Security for Debentures—Legal Requirements

If debentures are secured:

- Charge must be created

- Registered with ROC

- Assets must be clearly identified

Failure to register a charge weakens investor protection and creates compliance issues.

Public Issue vs Private Placement of Debentures

Debentures can be issued:

- Through public issue

- Through private placement

Private placement must also comply with:

- Section 42

- Section 71

- SEBI rules (if applicable)

Penalties for Violation of Section 71

If a company violates Section 71 of the Companies Act, 2013:

- Heavy fines can be imposed

- Officers in default can be penalized.

- The tribunal may intervene

- Investor claims may be enforced

Debenture law is taken seriously by regulators.

Common Mistakes Companies Make With Debentures

From real-world experience:

- Issuing convertible debentures without special resolution

- Skipping trustee appointment

- Ignoring redemption reserve

- Poor documentation

- Delayed redemption

These mistakes often surface during audits or funding rounds.

Why Debentures Are Popular Despite Regulation

Even with strict rules, debentures remain popular because:

- No ownership dilution

- Predictable cost of capital

- Flexible structuring

- Suitable for growth-stage companies

When structured correctly, debentures are powerful funding tools.

Debentures vs. Shares—Quick Comparison

|

Basis |

Debentures |

Shares |

|

Nature |

Debt |

Ownership |

|

Returns |

Fixed |

Variable |

|

Risk |

Lower |

Higher |

|

Voting rights |

No |

Yes |

|

Repayment |

Mandatory |

Not applicable |

Practical Advice for Companies Issuing Debentures

If your company plans to issue debentures:

- Review Articles of Association

- Decide type (secured / convertible)

- Plan redemption clearly

- Follow Section 71 strictly

- Maintain investor transparency

Debentures are safe only when compliance is strong.

Final Thoughts: Why Section 71 Matters

The debentures section in the Companies Act 2013, especially Section 71, ensures that corporate borrowing remains disciplined, transparent, and investor-friendly.

It balances:

- Company funding needs

- Investor protection

- Corporate governance

Knowledge of debenture law is not a ‘nice to know’ but a ‘must know’ for any business that is considering structured debt.

Having problems with debenture issuance, compliance, or structuring?

For expert advice on company law, fundraising, and corporate compliance, visit callmyca.com.