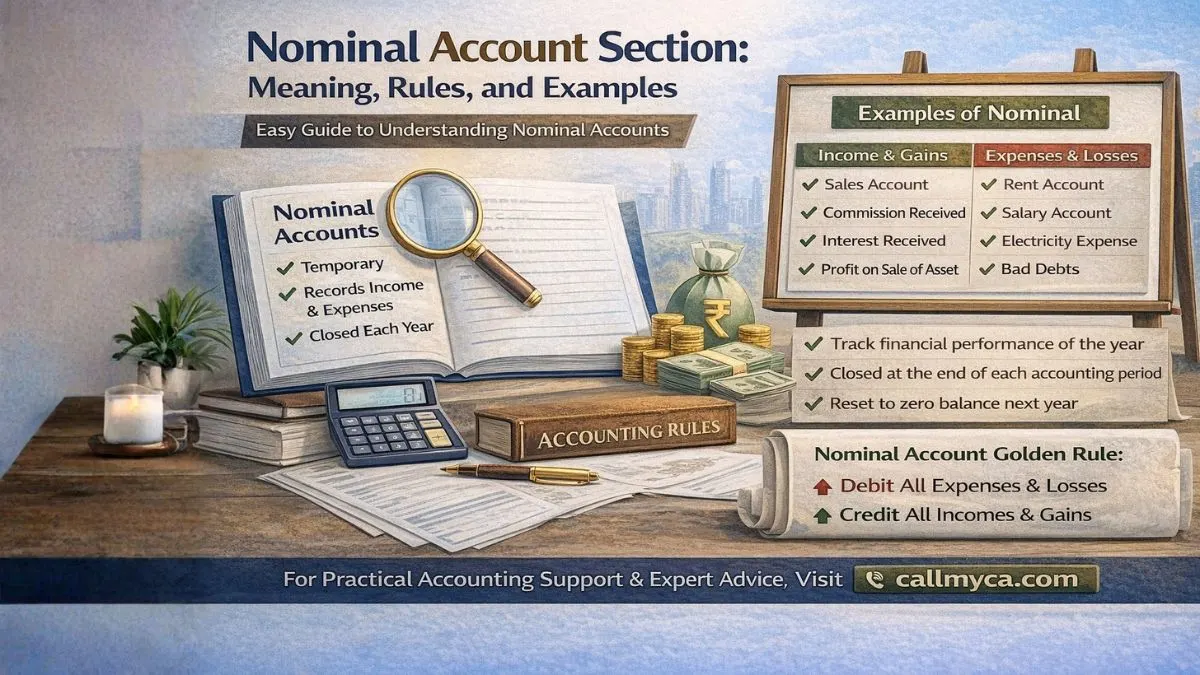

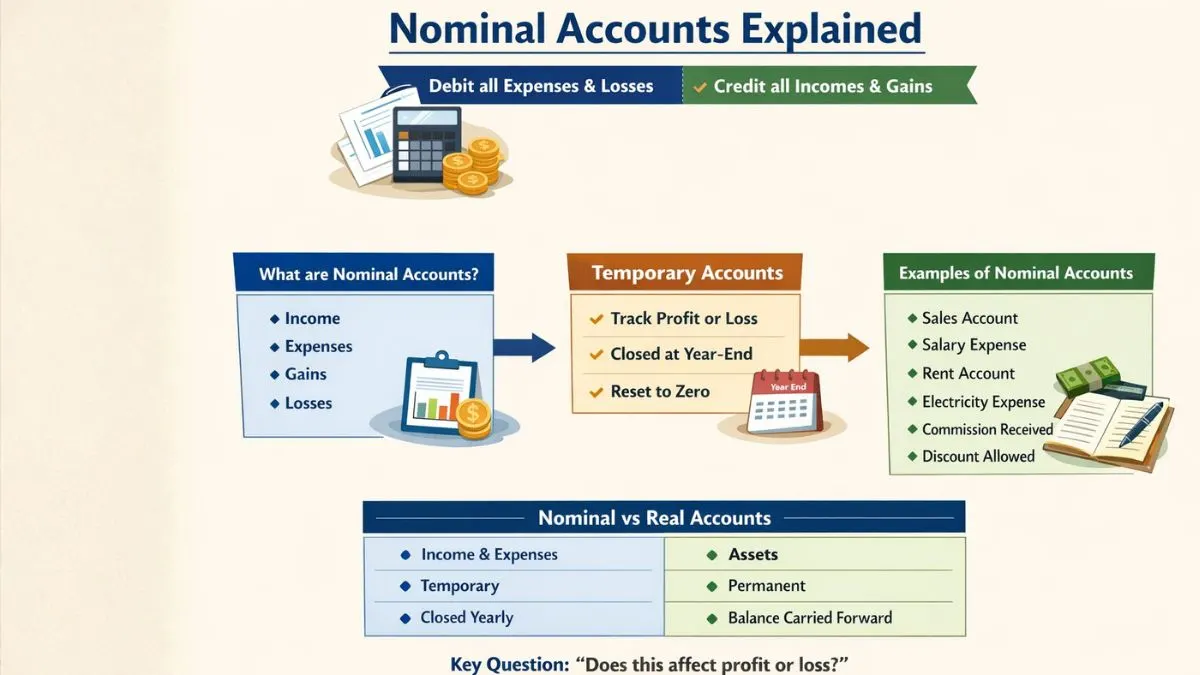

Nominal Accounts Explained: Meaning, Rules, Examples & Real-Life Understanding

If you’ve ever studied basic accounting, chances are you’ve heard this sentence at least once:

“Debit all expenses and losses, credit all incomes and gains.”

That single line is the nominal account rule—and behind it sits one of the most important concepts in accounting: nominal accounts.

Yet, despite being taught early, nominal accounts often remain confusing. People memorize the rule, write exams, pass them… and then struggle to apply it in real business or practical accounting work.

What Are Nominal Accounts?

A nominal account is a type of account that records:

- Income

- Expenses

- Gains

- Losses

In simple words, nominal accounts show the performance of a business for a specific period of time.

They answer one basic question:

“Did the business make a profit or a loss during this period?”

That’s it.

Nominal Accounts Are Temporary Accounts

One of the most important things to understand is this:

👉 Nominal accounts are temporary accounts.

This means:

- They are created for a specific accounting period

- They help calculate profit or loss for that period

- They are closed (reset to zero) at the end of the year

Once the year ends, these accounts do not carry forward their balances.

This is very different from permanent accounts like assets, liabilities, and capital.

Why Are Nominal Accounts Needed?

Imagine running a business for 10 years.

If you never reset income and expense accounts:

- Year 1 sales

- Year 2 sales

- Year 3 sales

All would keep adding up forever.

You would never know:

- How much you earned this year

- How much you spent this year

- Whether this year was profitable or not

Nominal accounts solve exactly this problem.

They:

- Track financial transactions over a set period of time

- Help prepare the income statement.

- Show gains, losses, income, or expenses of an organization.

Where Do Nominal Accounts Appear?

Nominal accounts appear in only one financial statement:

👉 Income Statement (Profit & Loss Account)

They do not appear on the balance sheet.

Why?

Because once profit or loss is calculated, nominal accounts are closed, and their net result is transferred to capital or retained earnings.

What Kind of Transactions Are Recorded in Nominal Accounts?

Nominal accounts are maintained to record monetary transactions related to performance, such as

- Revenue earned

- Expenses incurred

- Gains from activities

- Losses suffered

They do not record what the business owns or owes—only how it performed.

Examples of Nominal Accounts

Let’s make this very clear with examples.

Common Nominal Account Examples

- Salary Account

- Rent Account

- Electricity Expense Account

- Advertising Expense Account

- Sales Account

- Commission Received Account

- Interest Paid Account

- Interest Received Account

- Discount Allowed

- Discount Received

All these accounts either affect income or expenses.

That automatically makes them nominal accounts.

10 Examples of Nominal Accounts

Here’s a simple list of 10 examples of nominal account types:

- Sales Account

- Purchase Account

- Salary Expense Account

- Rent Expense Account

- Electricity Expense Account

- Advertisement Expense Account

- Commission Received Account

- Interest Received Account

- Discount Allowed Account

- Discount Received Account

If an account affects profit or loss, it is nominal.

Nominal Account Rule (Golden Rule)

Now let’s come to the most famous part.

Nominal Account Rule:

Debit all expenses and losses

Credit all incomes and gains

This rule is applied while passing journal entries.

But instead of memorizing it blindly, let’s understand why this rule exists.

Why Expenses Are Debited

Expenses reduce profit.

When profit reduces, capital also reduces.

Reduction in capital is recorded on the debit side.

That’s why:

- Salary

- Rent

- Electricity

- Advertising

All are debited.

Why Income Is Credited

Income increases profit.

An increase in profit increases capital.

An increase in capital is recorded on the credit side.

That’s why:

- Sales

- Commission received

- Interest received

All are credited.

Once you understand this logic, the nominal account rule becomes natural—not something to memorize.

Practical Example of Nominal Account Entry

Let’s take a simple example.

Example 1: Salary Paid

Salary paid ₹20,000 in cash.

- Salary is an expense → Nominal account

- Cash is an asset → Real account

Journal Entry:

Salary A/c Dr ₹20,000

To Cash A/c ₹20,000

(Being salary paid in cash)

Example 2: Commission Received

The commission received ₹5,000 in the bank.

- Commission received → Income → Nominal account

- Bank → Asset → Real account

Journal Entry:

Bank A/c Dr ₹5,000

To Commission Received A/c ₹5,000

Nominal Accounts vs Real Accounts vs Personal Accounts

Accounting traditionally divides accounts into three types:

1. Nominal Accounts

- Income & expenses

- Temporary

- Closed every year

2. Real Accounts

- Assets

- Permanent

- Carry forward balances

3. Personal Accounts

- Persons & entities

- Permanent

- Carry forward balances

Understanding this classification makes journal entries far easier.

Nominal Accounts vs Real Accounts (Quick Comparison)

|

Basis |

Nominal Accounts |

Real Accounts |

|

Nature |

Income & Expense |

Assets |

|

Type |

Temporary |

Permanent |

|

Appears in |

Income Statement |

Balance Sheet |

|

Closing |

Closed yearly |

Balance carried forward |

Why Nominal Accounts Are Closed at Year-End

This is a very common doubt.

Nominal accounts are closed because:

- Profit or loss must be calculated year-wise

- Each accounting year is treated separately

- Past performance should not mix with current performance

At year-end:

- All nominal accounts are transferred to Trading & P&L Account

- Net profit or loss is transferred to capital

After that:

👉 Nominal account balance becomes zero

What Happens If Nominal Accounts Are Not Closed?

If nominal accounts are not closed:

- Expenses will keep accumulating

- Income will keep accumulating

- Profit will be meaningless

- Financial statements will be misleading

Closing nominal accounts ensures clarity and accuracy.

Common Mistakes People Make With Nominal Accounts

From practical experience, these mistakes are very common:

1. Treating Nominal Accounts as Permanent

People assume salary or rent balances continue next year—they don’t.

2. Confusing Expense With Asset

For example, office rent is nominal, not real.

3. Memorising Rules Without Understanding

This leads to wrong journal entries in real situations.

Understanding logic is more important than rote learning.

How Nominal Accounts Help Business Owners

Even non-accountants should understand nominal accounts because they help you:

- Track expenses clearly

- Understand profitability

- Control unnecessary spending

- Analyse income sources

Your entire business performance depends on nominal accounts.

Real-Life Way to Identify a Nominal Account

Ask one simple question:

“Does this item affect my profit or loss?”

If the answer is yes, it is a nominal account.

No need to overthink.

Final Thoughts on Nominal Accounts

Let’s summarize everything simply:

- Nominal accounts record income, expenses, gains, and losses

- They are temporary accounts

- They appear in the income statement.

- They are closed at the end of every accounting period

- They help calculate profit or loss

If you truly understand nominal accounts, accounting stops being confusing and starts making sense.

Whether you are a student, business owner, or professional, mastering this concept gives you a strong foundation.

And if you ever need help with accounting, bookkeeping, or compliance—especially in real business situations—professional guidance can save both time and mistakes.

For expert support in accounting, taxation, and compliance, you can explore callmyca.com—because good accounting is not just about rules; it’s about clarity and control.