One Person Company (OPC) Under Companies Act, 2013:

For a very long time in India, starting a company meant one thing:

“Find a partner.”

Even if you didn’t need one.

Even if you trusted no one.

Even if you wanted full control.

People added dummy partners—cousins, friends, employees—just to meet the legal requirement.

That problem is exactly why the concept of a One Person Company (OPC) was introduced.

If you are a solo founder, freelancer, consultant, YouTuber, trader, or independent business owner, understanding the One Person Company under the Companies Act, 2013, can completely change how you structure your business.

Let’s understand OPC slowly, practically, and honestly.

What Is a One-Person Company?

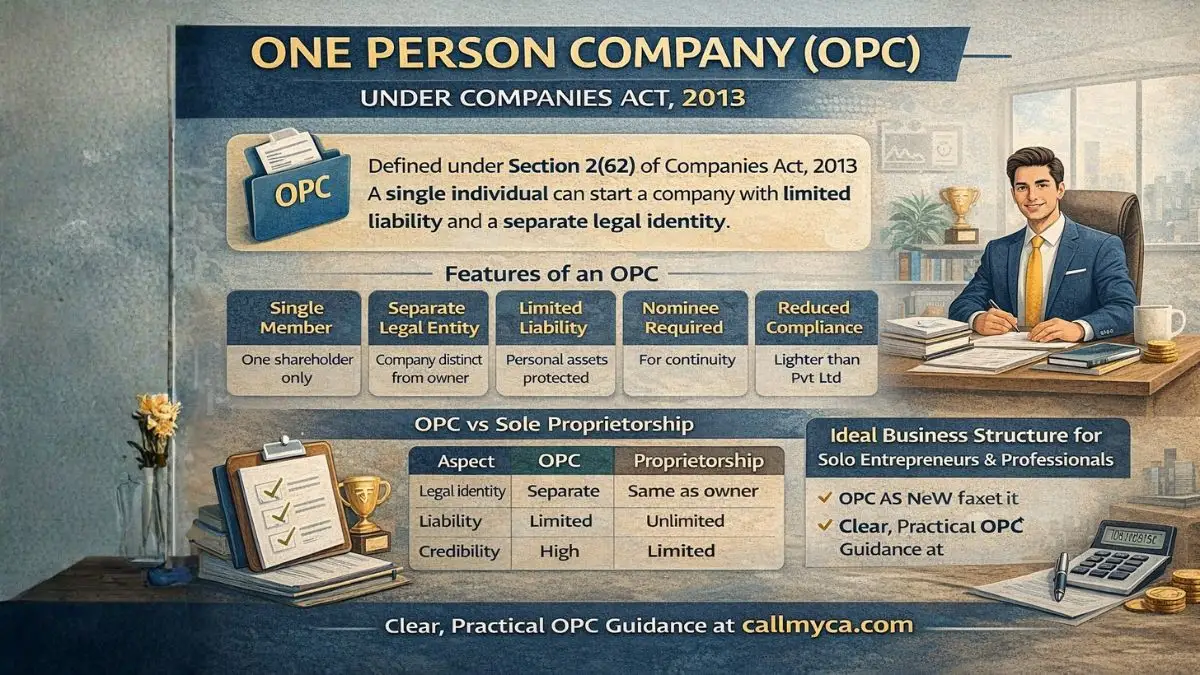

A One Person Company (OPC) is defined under Section 2(62) of the Companies Act, 2013.

In simple language:

A one-person company allows a single individual to form a company with limited liability and a separate legal identity.

This was a revolutionary idea when introduced.

It gave solo entrepreneurs the ability to:

- Operate alone

- Enjoy company benefits

- Avoid unlimited personal liability

All without adding fake partners.

One-Person Company Section Explained Simply

The one-person company section is Section 2(62) of the Companies Act, 2013.

It legally recognizes that:

- A company can exist with only one member

- That member can also be the director

- The company remains separate from the owner

So even though there is only one person behind the company, the law treats the company as a separate person.

That separation is extremely important.

Why OPC Was Introduced in India

OPC was introduced to solve a very real problem.

Before OPC:

- Sole proprietors had unlimited liability

- Private limited companies needed at least two shareholders

- Solo professionals were stuck in between

OPC created a bridge between:

- Sole proprietorship (simple but risky)

- Private limited company (safe but compliance-heavy)

It gave solo founders:

- Legal recognition

- Limited liability

- Corporate credibility

Without unnecessary complexity.

Separate Legal Entity: The Biggest Advantage of OPC

This is where OPC changes everything.

A one-person company has:

- Its own PAN

- Its own bank account

- Its own legal identity

This means:

- Company assets ≠ personal assets

- Company debts ≠ personal debts

If the business fails, your personal house, savings, or investments are not automatically at risk.

For solo founders, this is a massive relief.

Limited Liability: Why It Matters

Many people underestimate this. in Real Life

Many people underestimate this.

In a sole proprietorship:

- If business fails, owner pays personally

In an OPC:

- Liability is limited to the company

- Personal risk is restricted

This is why consultants, freelancers, and professionals increasingly prefer OPC over proprietorship.

Nominee Requirement in OPC

Because an OPC has only one member, the law requires a nominee.

A nominee is

- A person named at incorporation

- Who will take over the company in case of death or incapacity of the owner

This ensures continuity.

Important points:

- The nominee has no control during your lifetime

- The nominee steps in only if something happens to you

- Nominee consent is mandatory

This makes OPC legally stable.

Who Can Form a One-Person Company?

This is where some restrictions apply.

An OPC can be formed only by:

- A natural person

- Who is an Indian citizen

- Who is a resident in India

Also:

- One person can form only one OPC

- A person cannot be nominee in more than one OPC

This ensures OPC is not misused.

Who Cannot Form an OPC?

An OPC cannot be:

- A Non-Banking Financial Company (NBFC)

- A company under Section 8 (charitable company)

- Used for investment or lending activities

The structure is meant for operating businesses, not financial entities.

Features of One-Person Company

Let’s break down the one-person company features in real terms.

1. Single Member

Only one shareholder is required.

2. Single Director Allowed

One director is sufficient (can be the same person).

3. Limited Liability

Personal assets are protected.

4. Separate Legal Entity

The company exists independently.

5. Reduced Compliance

Compared to private limited companies.

6. Perpetual Succession

The nominee ensures continuity.

These features make OPC ideal for solo entrepreneurs.

One-Person Company Examples

Let’s make this practical.

OPC is suitable for:

- Freelance consultants

- Digital marketers

- Content creators

- Software developers

- Architects

- Designers

- Independent traders

- Small manufacturers

Example:

A freelance CA earning ₹30–40 lakhs annually can run operations smoothly through an OPC instead of a proprietorship.

One-Person Company Turnover Limit (Important Update)

Earlier, OPCs had strict limits.

But now:

- No turnover limit

- No paid-up capital limit

This change made OPC far more flexible.

Earlier conversion requirements were restrictive, but current rules allow OPCs to grow without forced conversion.

OPC vs Sole Proprietorship (Real Difference)

|

Aspect |

OPC |

Proprietorship |

|

Legal identity |

Separate |

Same as owner |

|

Liability |

Limited |

Unlimited |

|

Credibility |

High |

Limited |

|

Compliance |

Moderate |

Low |

|

Tax planning |

Better |

Limited |

If you’re serious about growth, OPC is usually a better long-term structure.

OPC vs Private Limited Company

OPC is not a replacement for Pvt Ltd—it is a stepping stone.

Private limited is better when:

- You want investors

- You want multiple founders

- You plan large-scale expansion

OPC is perfect when:

- You are solo

- You want control

- You want protection

- You want credibility

Taxation of One-Person Company

This is where people often get confused.

A one-person company is taxed like:

👉 Any other private limited company

That means:

- Corporate tax applies

- Not slab-based like individuals

Tax planning becomes structured, but compliance increases slightly compared to proprietorship.

Compliance Requirements of OPC

OPC enjoys reduced compliance, but not zero compliance.

Key requirements:

- Annual return filing

- Financial statement filing

- Income tax return

- Audit (mandatory)

Still, compliance is lighter than multi-member companies.

Common Misconceptions About OPC

“OPC is only for small businesses.”

Wrong. There is no turnover cap.

“OPC is complicated.”

No. It’s simpler than Pvt Ltd.

“OPC is risky.”

Actually, it reduces personal risk.

“OPC is temporary.”

Many successful solo founders operate OPCs long-term.

When OPC Is NOT a Good Idea

OPC may not be suitable if:

- You want to raise equity funding

- You want partners soon

- You want ESOP structures

- You plan public listing

In such cases, a private limited company works better.

Real-Life Thought Before Choosing OPC

Ask yourself:

- Do I want full control?

- Do I want limited liability?

- Am I working solo?

- Do I want company credibility?

If most answers are “yes,” OPC is worth considering.

Final Thoughts on One-Person Company Section

Let’s summarize clearly:

- One Person Company is defined under Section 2(62) of Companies Act, 2013

- It allows a single individual to run a company

- It provides limited liability and separate legal identity

- It requires a nominee

- It has reduced compliance

- It is ideal for solo founders and professionals

OPC quietly changed how solo entrepreneurs operate in India.

It removed the need for fake partners.

It gave dignity to independent business owners.

And it provided legal protection without complexity.

If you are considering OPC registration, compliance, or conversion planning, professional guidance can save you future headaches.

For expert help in OPC registration, taxation, and compliance, you can explore callmyca.com—because choosing the right structure at the right time makes all the difference.