Penalty Sections Under GST Explained

If you run a business, handle GST filings, or advise clients, you have probably searched the penalty section under GST at least once—usually after receiving a notice that starts with the words “short payment of tax” or “wrong availment of ITC.”

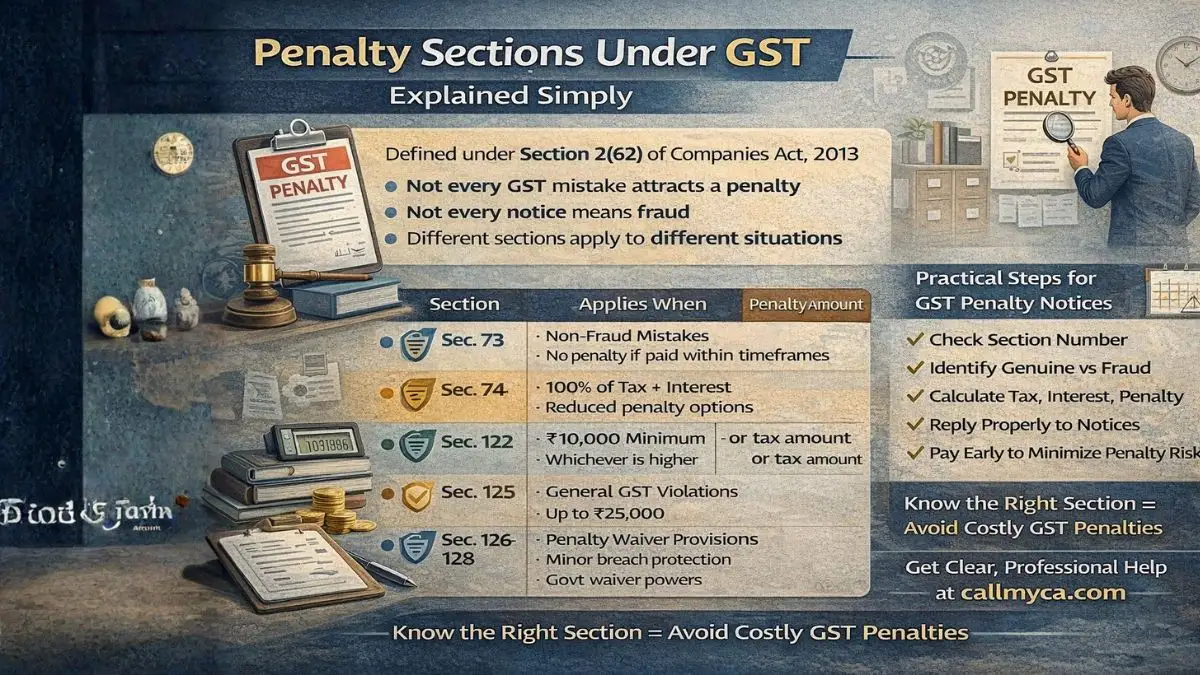

GST penalties sound scary, but here’s the truth:

👉 Not every GST mistake attracts a penalty

👉 Not every notice means fraud

👉 Different sections apply to different situations

The problem is that most people don’t understand which penalty section applies and why.

Where Are GST Penalty Provisions Covered?

The penalty provisions under the Goods and Services Tax (GST) laws are mainly covered under:

- Sections 122 to 128 of the CGST Act

- Along with specific recovery provisions in:

- Section 73

- Section 74

- Section 129

- Section 73

Each section applies to a different type of default.

Penalty vs Tax vs. Interest—First Clear the Confusion

Before going section-wise, understand this:

- Tax → What you were supposed to pay

- Interest → Compensation for delay

- Penalty → Punishment for non-compliance

A penalty is not automatic in every GST case.

Penalty Under GST Section 73 – Non-Fraud Cases

One of the most common searches is penalty under GST section 73.

When Does Section 73 Apply?

Section 73 applies when:

- Tax is not paid or short-paid.

- ITC is wrongly availed

- The refund is wrongly taken

- WITHOUT fraud, wilful misstatement, or suppression

In short:

👉 Genuine mistakes

Is There a Penalty Under Section 73?

Here’s the relief most people don’t know:

- If tax interest is paid before notice → NO PENALTY

- If paid within 30 days of notice → NO PENALTY

A penalty under Section 73 arises only if payment is ignored.

This is why Section 73 is considered a lenient provision.

Penalty Under GST Section 74 – Fraud Cases

Now comes the serious one: penalty under GST section 74.

When Does Section 74 Apply?

Section 74 applies when tax default is due to:

- Fraud

- Wilful misstatement

- Suppression of facts

In simple words:

👉 Intentional tax evasion

Penalty Amount Under Section 74

- Penalty = 100% of tax amount

- Plus interest

- Plus tax

This is why Section 74 notices should never be ignored.

Reduced Penalty Options Under Section 74

The law still gives chances:

- Payment before notice → 15% penalty

- Payment within 30 days of notice → 25% penalty

- Payment after order → 50% penalty

This is why people search 15% penalty under GSTgst so often.

Penalty Under Section 122 of GST – Specific Offences

The penalty under section 122 of GST applies to specific listed offenses, regardless of intent.

Some common offenses include:

- Supplying goods without invoice

- Issuing fake invoices

- Wrong ITC availment

- Collecting GST but not paying to government

Penalty Amount Under Section 122

- Minimum penalty: ₹10,000

- OR tax amount involved

- Whichever is higher

This section is frequently used during audits and inspections.

Penalty in GST Without Bill—A Very Common Issue

Many traders search for a penalty in GST without a bill after goods are intercepted.

If goods are supplied without invoice:

- Section 122 applies

- Section 129 may also apply (detention)

Penalties can include:

- Tax penalty equal to tax

- Or confiscation risk in repeated cases

Section 129 – Penalty for Detention of Goods

Section 129 applies when:

- Goods are transported without proper documents

- E-way bill issues

- Invoice mismatches

Penalties depend on:

- Whether owner comes forward

- Nature of violation

This section is procedural but strict.

General Penalty Under GST Section 125

Many people overlook the general penalty under GST section 125, but it plays a big role.

When Does Section 125 Apply?

When:

- A violation occurs

- But no specific penalty is provided elsewhere

Penalty Amount Under Section 125

- Maximum penalty: ₹25,000

This is a fallback section used by officers when no other penalty section fits.

Sections 122 to 128 – The Penalty Framework

Let’s simplify sections 122 to 128:

|

Section |

Purpose |

|

122 |

Specific GST offences |

|

123 |

Failure to furnish information |

|

124 |

Failure to explain data |

|

125 |

General penalty |

|

126 |

General discipline principles |

|

127 |

Power to impose penalty |

|

128 |

Power to waive penalty |

Section 126 – Protection Against Harsh Penalties

Section 126 is often ignored, but it’s important.

It says:

- The penalty should be proportionate

- Minor breaches should not attract heavy penalties.

- Intent matters

This section protects genuine taxpayers.

GST Penalty Calculator—Does It Exist?

People often search for a GST penalty calculator, but there is no official one.

The penalty depends on:

- Section applied

- Tax amount

- Timing of payment

- Intent (fraud vs non-fraud)

Each case is fact-specific.

Offences and Penalties Under GST PDF – Why People Search It

Many professionals search offenses and penalties under GST PDF because:

- GST law is scattered

- Multiple sections apply

- One mistake can attract multiple penalties

But understanding logic over memorization works better.

Common GST Mistakes That Lead to Penalties

From real-world practice, these mistakes cause most penalties:

- ITC mismatch with GSTR-2B

- Late payment despite return filing

- E-way bill errors

- Wrong classification

- Ignoring notices

Most of these are avoidable.

Can GST Penalties Be Waived?

Yes, in some cases.

- Section 128 gives government power to waive penalties

- Used during:

- Amnesty schemes

- Special notifications

- COVID relief periods

- Amnesty schemes

But a waiver is not a right; it’s discretionary.

Penalty vs. Prosecution—Don’t Confuse Them

Penalty:

- Monetary consequence

Prosecution:

- Criminal proceedings

- Jail possible in extreme cases

Most GST cases end at the penalty stage, not prosecution.

How to Respond to a GST Penalty Notice

If you receive a notice:

- Identify applicable section

- Check whether fraud is alleged

- Verify timelines

- Pay early if possible

- Reply properly, not casually

Many penalties escalate simply due to poor replies.

Practical Advice for Businesses

To avoid GST penalties:

- Reconcile returns monthly

- Track notices actively

- Don’t ignore small mismatches

- Maintain invoice discipline

- Seek advice early

GST rewards compliance and punishes carelessness.

Final Thoughts: Understanding GST Penalty Sections Saves Money

The penalty section under GST is not one single rule—it’s a complete system.

Understanding:

- Section 73 vs 74

- Section 122 vs 125

- Fraud vs genuine error

can save:

- Money

- Time

- Reputation

GST penalties are avoidable if handled correctly and on time.

Need help with GST notices, penalties, or compliance strategy?

Visit callmyca.com for practical, professional guidance on GST, audits, and tax compliance.