RCM Section Under GST Explained Simply (With Services List & Practical Examples)

If you run a business, manage accounts, or file GST returns, chances are you’ve searched the RCM section under GST after seeing a confusing entry in your purchase register that says “GST payable under reverse charge.”

And that moment usually brings panic.

“Why am I paying GST when the supplier should pay?”

“Can I claim ITC on this?”

“Which section applies?”

“Is this still applicable in 2025?”

Let’s slow everything down and explain the Reverse Charge Mechanism (RCM) the way it actually works in real life—not like a legal textbook.

What Is Reverse Charge Mechanism (RCM) Under GST?

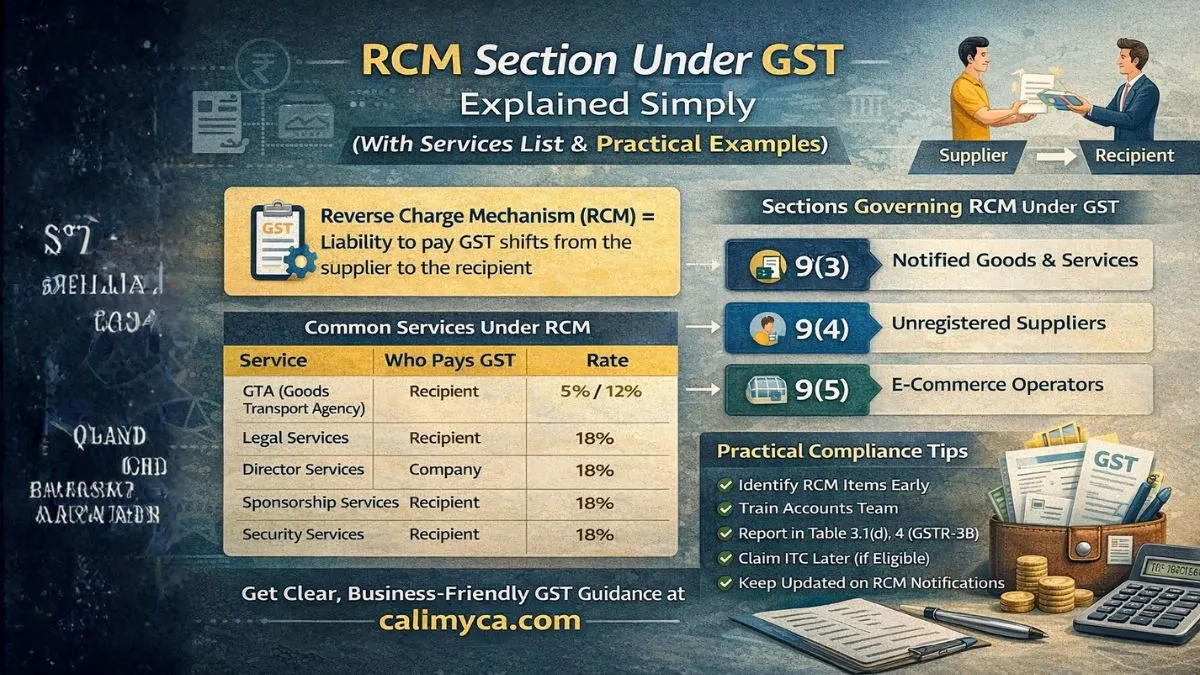

The Reverse Charge Mechanism (RCM) means:

The liability to pay GST shifts from the supplier to the recipient of goods or services.

In normal GST:

- Supplier charges GST

- The supplier pays GST to the government.

Under RCM:

- The supplier does not charge GST

- The recipient pays GST directly to the government.

That’s the only difference—but it changes compliance completely.

RCM Section Under GST—Which Sections Govern It?

The RCM section under GST is governed by multiple sections, not just one.

Under the CGST Act, 2017:

- Section 9(3)

- Section 9(4)

- Section 9(5)

And under the IGST Act:

- Sections 5(3), 5(4), and 5(5)

Each section applies to different situations, which is where most confusion arises.

Section 9(3) of GST – RCM on Notified Goods & Services

Section 9(3) of the GST list of services is the most commonly used RCM provision.

What Section 9(3) Says (In Simple Words)

The government can notify:

- Certain goods

- Certain services

On which:

👉 GST must be paid by the recipient, not the supplier.

This applies even if the supplier is registered.

List of Services Under RCM in GST (Section 9(3))

This is one of the most searched topics:

- list of services under RCM in GST notification

- list of services under RCM in GST with rate

- list of services under RCM in GST pdf

Let’s simplify it.

Common Services Under RCM

|

Service |

Who Pays GST |

Rate |

|

GTA (Goods Transport Agency) |

Recipient |

5% / 12% |

|

Legal services by advocate |

Recipient |

18% |

|

Services by director to company |

Company |

18% |

|

Sponsorship services |

Recipient |

18% |

|

Services by government/local authority |

Recipient |

18% |

|

Security services (non-body corporate) |

Recipient |

18% |

These are notified via RCM notification under GST issued from time to time.

Why Government Uses Section 9(3)

RCM under Section 9(3) exists because:

- Some suppliers are unorganized.

- Collection from them is difficult

- Recipients are easier to track

RCM improves tax compliance at the buyer level.

List of Goods Under RCM in GST

RCM also applies to certain goods.

Common Goods Under RCM

|

Goods |

Who Pays GST |

|

Cashew nuts (unprocessed) |

Recipient |

|

Tobacco leaves |

Recipient |

|

Silk yarn |

Recipient |

|

Supply of lottery |

Recipient |

So yes, a list of goods under RCM in GST exists, though services dominate RCM.

Section 9(4) of GST – RCM on Unregistered Suppliers

This section causes the most confusion.

What Section 9(4) Means

RCM applies when:

- A registered person

- Purchases goods or services

- From an unregistered supplier

- In notified cases only

Important:

👉 Section 9(4) is not blanket applicable anymore

Most routine purchases from unregistered persons do not attract RCM unless notified.

Section 9(5) of GST – RCM for E-Commerce Operators

Section 9(5) applies in special cases where:

- Services are supplied through an e-commerce operator

- The operator is made liable to pay GST

Examples include:

- Cab services

- Accommodation services

- Certain online platforms

Here:

- The supplier doesn’t pay GST

- The recipient doesn’t pay GST

- The e-commerce operator pays GST

This is a special form of reverse charge.

RCM Notification Under GST – Why Notifications Matter

RCM does not apply automatically.

It applies only when:

- The government issues a notification

- Under Section 9(3), 9(4), or 9(5)

That’s why people search:

- rcm notification under gst pdf

- rcm list under gst 2025 pdf

Always rely on the latest notifications, not old lists.

RCM List Under GST 2025—What to Know

For the RCM list under GST 2025:

- No major removals so far

- Legal services, GTA, director services continue

- Rates remain mostly unchanged

- Compliance scrutiny has increased

RCM is very much alive in 2025.

How RCM Actually Works in Accounting

Let’s see the practical flow.

- The supplier issues invoice without GST

- The invoice mentions “Tax payable under RCM.”

- Recipient calculates GST

- The recipient pays GST in cash

- Recipient claims ITC (if eligible)

Yes—consideration paid to the supplier will exclude GST.

Can ITC Be Claimed on RCM?

Yes, but with conditions.

- GST paid under RCM must be paid in cash

- ITC can be claimed after payment

- ITC must be used for taxable supplies

RCM is cash-flow negative initially but ITC neutral later.

RCM in GSTR-3B—Where Is It Reported?

RCM must be reported in:

- Table 3.1(d) – Tax payable under RCM

- Table 4 – ITC on RCM

Mismatch here is a common cause of notices.

Common Mistakes Businesses Make Under RCM

From real-world practice, these errors cause the most trouble:

- Missing director remuneration under RCM

- Ignoring legal fee invoices

- Wrong GST rate on RCM

- Claiming ITC without paying tax

- Not disclosing RCM in returns

RCM mistakes are easily detectable in audits.

Penalty for Non-Compliance With RCM

Failure to comply can lead to:

- Tax demand

- Interest

- Penalty under Section 73 or 74

- ITC reversal

RCM defaults are treated as short payment of tax.

RCM vs Forward Charge—Quick Comparison

|

Basis |

Forward Charge |

RCM |

|

Who pays GST |

Supplier |

Recipient |

|

The invoice shows GST |

Yes |

No |

|

ITC availability |

Normal |

After payment |

|

Cash outflow |

Supplier |

Recipient |

Understanding this difference avoids confusion.

Does RCM Apply to Composition Dealers?

Yes.

Even composition dealers:

- Must pay GST under RCM

- Cannot claim ITC

This often comes as a surprise.

Why RCM Is Closely Scrutinised by GST Department

Because:

- Tax is paid directly by the buyer.

- High scope of non-reporting

- Easy data matching

- Common compliance gaps

RCM is a favorite audit point.

Practical Compliance Tips for RCM

If RCM applies to your business:

- Identify RCM services early

- Train billing and accounts team

- Maintain separate RCM ledger

- Pay tax on time

- Reconcile monthly

RCM is manageable once systems are in place.

Final Thoughts: RCM Section Under GST Made Simple

The RCM section under GST is not one single rule—it’s a framework built through:

- Sections 9(3), 9(4), and 9(5)

- Supported by notifications

- Enforced through audits

RCM exists to ensure tax collection where normal GST fails.

If you understand:

- When it applies

- What rate applies

- How to report it

RCM stops being scary and becomes routine compliance.

Need help with RCM applicability, GST returns, or audit support?

Visit callmyca.com for practical, business-friendly GST guidance—explained clearly, without confusion or fear.