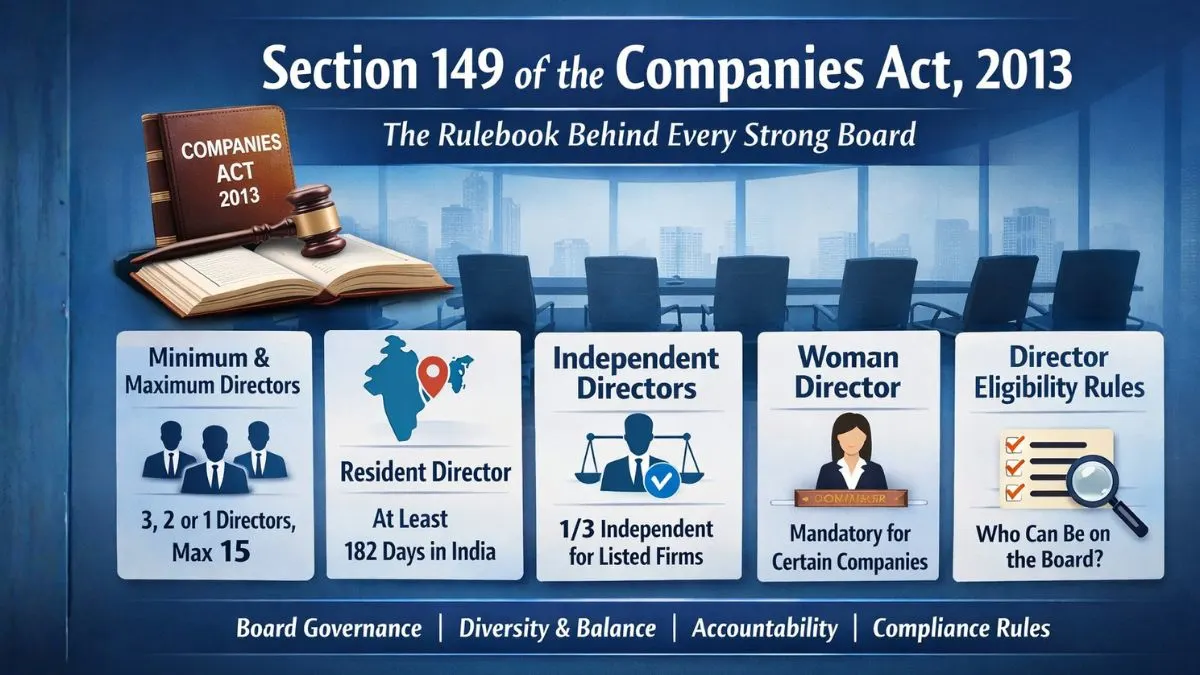

Section 149 of the Companies Act, 2013: The Rulebook Behind Every Strong Board

Every business starts with an idea.

Sometimes it’s a small thought.

Sometimes it’s a big dream.

Sometimes it’s just, “Let’s try and see what happens.”

But here’s something most founders don’t realize early on:

From a legal point of view, a company doesn’t really begin with that idea.

It begins with its Board of Directors.

Because in the eyes of the law, if your board isn’t properly formed, your company isn’t really “complete.”

And this is where Section 149 of the Companies Act, 2013, quietly steps in.

No drama. No hype. No marketing.

Just solid rules that decide who sits at the table where all major decisions are made.

So… What Is Section 149 Actually About?

At its heart, Section 149 talks about just one thing:

👉 Who runs the company from the top?

It lays down:

-

How many directors you need

-

Who can become a director

-

And what extra rules some companies must follow

Why does this matter?

Because without rules, most boards would end up being run by just one powerful person—or a close group of insiders.

No questions.

No pushback.

No accountability.

Section 149 exists to prevent exactly that.

How Many Directors Do You Need? (Section 149(1))

Let’s keep this simple.

Minimum directors required:

-

Public Company → 3

-

Private Company → 2

-

One Person Company → 1

Maximum allowed → 15

If you want more than 15, you need shareholders’ approval through a special resolution.

Think of it like this:

Too few people = risky decisions.

Too many people = chaos.

The law tries to keep things balanced.

Why One Director Must Live in India

Every company must have at least one resident director.

Meaning: someone who has stayed in India for at least 182 days in a year.

Why is this important?

Because regulators don’t want a situation where:

“Everyone is abroad. Nobody is responsible.”

There should always be someone on the board who is physically present and answerable in India.

Simple. Practical. Necessary.

Independent Directors: The “Reality Check” on the Board

This is one of the smartest parts of Section 149.

For listed companies, at least one-third of the board must be independent.

Some big unlisted companies also have to follow this.

Independent directors are not there to please promoters.

They are there to ask uncomfortable questions.

They bring:

-

Objectivity

-

Experience

-

A fresh perspective

In many cases, they are the only ones in the room who can say:

“Wait. Is this really the right decision?”

Who Can Be an Independent Director? (Section 149(6))

Not everyone qualifies.

The law is very clear.

An independent director must:

-

Be honest and credible

-

Have real professional experience

-

Not be financially dependent on the company

-

Not be related to promoters

-

Not hold major shares

Why so many conditions?

How Long Can Independent Directors Stay?

They are appointed for up to 5 years.

They can be reappointed once more.

So maximum → 10 continuous years.

After that, they must take a 3-year break.

No consulting.

No advisory roles.

No hidden connections.

The Code They Must Follow (Schedule IV)

Independent directors don’t just get a title.

They get responsibilities.

Schedule IV lays down their code of conduct, including:

-

How they should behave professionally

-

How they should protect shareholders

-

How they should evaluate management

-

How they should handle conflicts

They are expected to act like guardians of good governance.

Why Companies Need a Woman Director

Section 149 also talks about diversity.

Certain companies must appoint at least one woman director.

This isn’t just about ticking a box.

Different experiences bring different viewpoints.

And better viewpoints usually lead to better decisions.

Are Independent Directors Always Liable?

No. And that’s important.

They are responsible only if something goes wrong because of:

-

Their knowledge

-

Their approval

-

Their involvement

-

Or their negligence

They are not meant to be scapegoats.

This protection encourages good professionals to join boards without fear.

How Section 149 Works with Other Laws

Section 149 doesn’t stand alone.

It works along with:

-

Section 150: How independent directors are selected

-

Section 152: How directors are appointed

-

Section 161 → Additional and alternate directors

Together, they create the complete board framework.

Why Section 149 Really Matters in Real Life

Without this section, many boards would become “yes-men clubs.”

Promoters decide.

Others agree.

Nobody questions.

Section 149 changes that.

It ensures:

-

Power is shared

-

Decisions are reviewed

-

Risks are discussed

-

Stakeholders are protected

It turns a board into a real governing body.

Simple Compliance Tips for Companies

If you’re running a company, keep this in mind:

-

Check your board structure every year

-

Track independent director tenure

-

Ensure resident and woman director rules are met

-

Keep disclosures updated

-

File forms on time

Small mistakes here can become big problems later.

Final Thoughts

Section 149 is not “just another section.” ”.

It decides:

Who gets a voice?

Who gets power?

Who gets questioned?

A strong board is not a cost.

It’s protection.

It’s credibility.

It’s long-term strength.

And Section 149 makes sure every serious company has one.

Need Professional Help?

If you need help with director appointments, independent director rules, or Companies Act compliance,

Visit Callmyca.com for expert and hassle-free support.