When it comes to income tax, some definitions carry more weight than the law itself. Fair Market Value (FMV) is one such concept. Whether you're calculating capital gains on a property bought decades ago, valuing shares, or dealing with inheritance, FMV decides the tax you pay.

Section 2(22B) of the Income-tax Act, 1961, defines “fair market value” in relation to a capital asset.

In simple terms, it helps determine the price that asset would reasonably fetch if sold in an open market during a relevant period.

Without FMV, capital gains would be chaotic—and unfair. Let’s break this down in a way that feels truly understandable.

What Does Section 2(22B) Actually Say?

Section 2(22B) defines FMV in relation to a capital asset such as:

- Land

- Building

- Shares

- Jewellery

- Any other valuable property"

According to this section, fair market value is the price a capital asset would ordinarily sell for in the open market during a specific period.

Also Read: Deemed Dividend and Its Tax Implications

Why FMV Matters So Much in Capital Gains

FMV affects how your capital gains are computed. A tiny difference in FMV can change your tax liability significantly.

Here’s why FMV often becomes important:

- When you sell an inherited asset"

- When you transfer a gift

- When the purchase price is unclear

- When assets were acquired long ago

- When the tax law allows substitution of FMV instead of cost (like 1 April 2001 valuation earlier)

- When the actual sale price seems undervalued or inflated

In all these cases, the price of capital gains sold on a relevant period in the open market is FMV, & tax calculations depend on it.

A Simple, Real-Life Example

A family friend inherited a small piece of land bought by his grandfather in the 1960s for just ₹9,000. When he sold it recently, the buyer’s price & the old purchase price had absolutely no connection.

To compute capital gains, the tax law couldn’t use ₹9,000—that wouldn’t make sense in today’s world. Instead, the law used FMV for the relevant year.

That one definition protected him from an absurdly high tax burden. This is exactly why Section 2(22B) matters.

How FMV Is Determined

Depending on the nature of the asset, FMV may be determined through:

- A registered valuer

- Stamp duty valuation

- Stock market prices

- Valuation rules under Income Tax Rules (like Rule 11UA/11UB)

- Government-approved valuation methods

The purpose is to arrive at a fair, unbiased, market-backed value.

Also Read: Loans from Your Company? How Section 2(22)(e) Turns It Into a Taxable Dividend

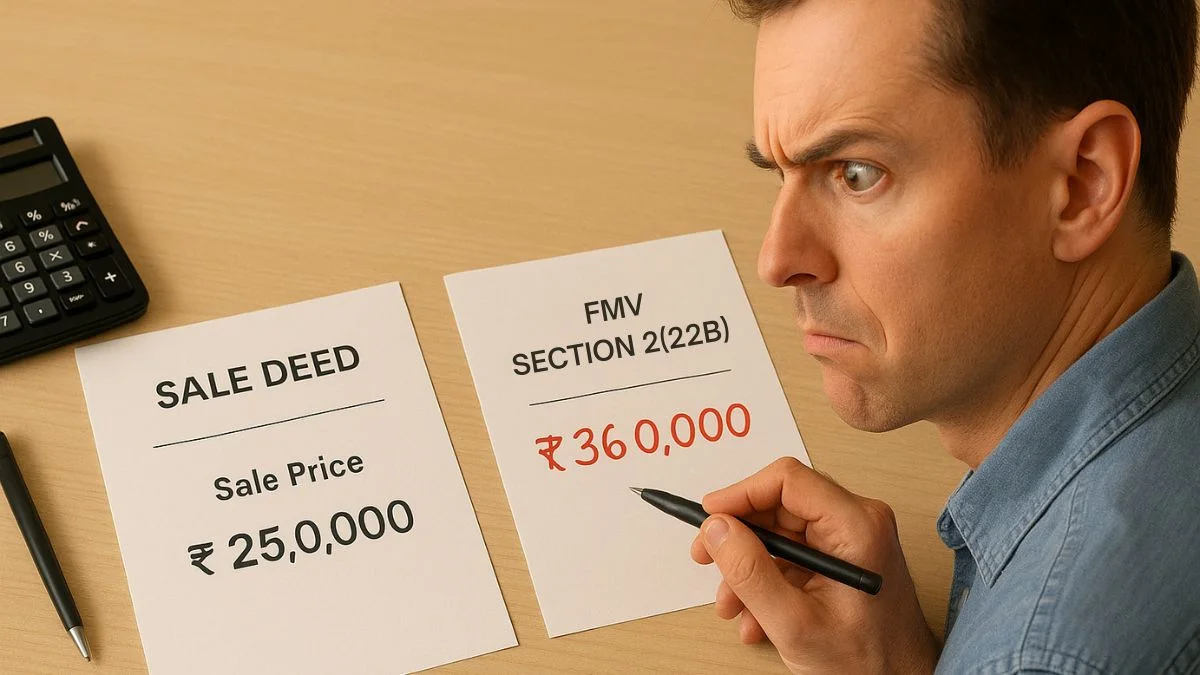

FMV vs Actual Sale Price

Sometimes the actual sale price is suspiciously low or unusually high.

To prevent tax manipulation:

- If a property is sold below FMV, the law may treat FMV as the sale consideration.

- If shares are issued or transferred above or below FMV, various anti-abuse provisions kick in (like Section 50CA, 56(2)(x), 56(2)(viib)).

FMV ensures capital gains taxation stays fair on both sides.

Where Section 2(22B) Commonly Applies

You’ll see FMV being used in:

- Capital gains computation

- Gift taxation

- Share valuation

- Property transfers

- Business reorganisations

- Inheritance or succession

- Assessments when price is not ascertainable

FMV becomes the anchor point that prevents confusion and protects both taxpayer & tax department.

Why This Definition Feels “Technical” but Is Actually Very Human

At first glance, FMV sounds like a boring legal term. But if you think about it, it’s a very human concept.

We all want to be taxed on what is reasonable & fair, not on outdated prices or unrealistic numbers.

Section 2(22B) ensures exactly that.

It brings fairness, neutrality, & real-world logic into capital gains taxation.

Also Read: Deeming Provisions on Employee Contributions

Key Takeaways

- Section 2(22B) defines what “fair market value” means under the law.

- FMV is the price an asset would sell for in the open market."

- It is crucial for calculating capital gains & ensuring fairness.

- FMV applies when original cost is unknown, outdated, or irrelevant.

- Valuation may require a valuer, market price, or stamp duty value.

Understanding FMV can save you from both stress & unnecessary tax.

Conclusion

Section 2(22B) may look like a simple definition section, but it plays a powerful role in making capital gains taxation just & sensible. It ensures that taxpayers are assessed based on what an asset is actually worth—not what it once cost or emotionally means.

If you ever find yourself confused about valuations, FMV, or capital gains, the experts at CallMyCA.com can help you navigate it all with clarity and confidence.