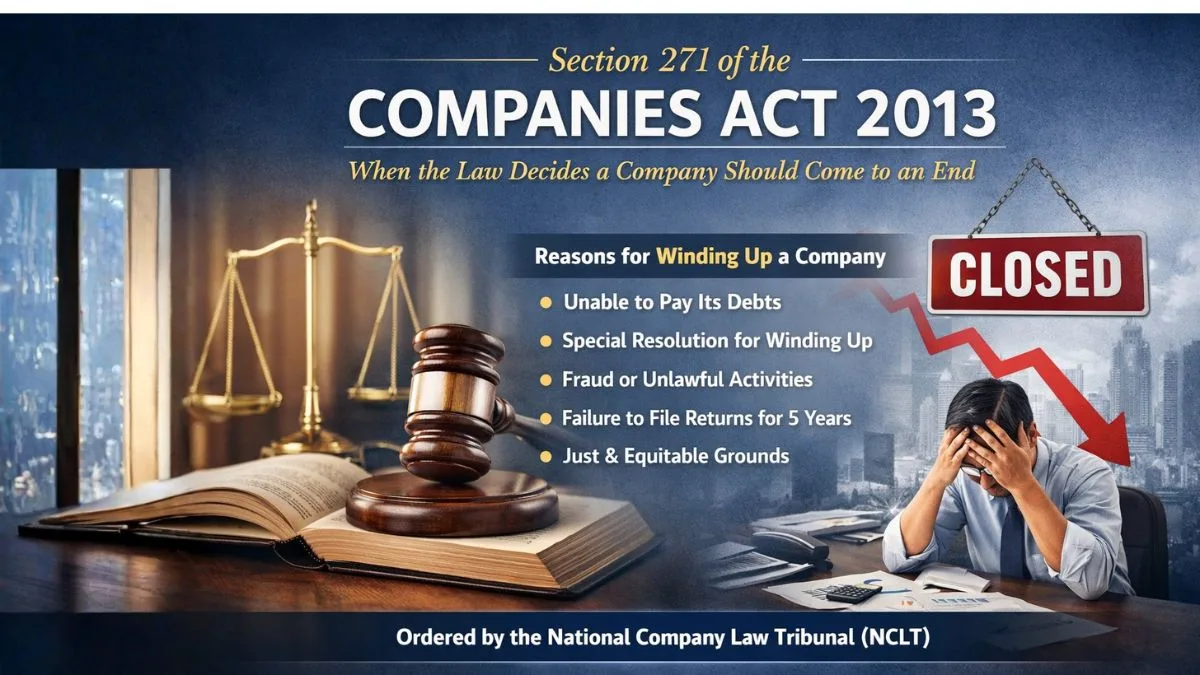

Section 271 of Companies Act 2013: When the Law Decides a Company Should Come to an End

Starting a company is exciting.

There’s hope. There’s ambition. There’s that feeling of “We’re building something big.”

But shutting down a company—especially when it happens through a court order—is something no founder ever plans for.

Yet, in the real world, not every business survives.

Some struggle financially.

Some lose direction.

Some ignore compliance.

And some, unfortunately, cross legal boundaries they never should have crossed.

That’s exactly where Section 271 of Companies Act 2013 comes in.

This section outlines the circumstances under which the National Company Law Tribunal (NCLT) can order a company to be wound up (compulsorily dissolved). In simple terms, it explains when the law steps in and says:

“This company should no longer continue.”

This isn’t about small penalties.

This isn’t about late fees.

This is about the end of a company’s legal life.

And that’s why every founder, director, shareholder, and professional should understand it properly.

Let’s break it down—calmly and practically.

What Is Section 271 of the Companies Act 2013?

Section 271 lays down the specific circumstances under which a company can be compulsorily wound up by the Tribunal.

In simple words, it tells us:

-

When a company can be shut down legally

-

Who has the authority to do it

-

On what grounds it can happen

Under this section, the power lies with the National Company Law Tribunal (NCLT).

This means winding up is never automatic.

It happens only after:

-

A proper legal petition

-

Examination of records

-

Hearing all parties

-

A detailed judicial order

What Does “Company Winding Up” Really Mean?

Many people misunderstand this.

They think winding up means:

-

A bad business year

-

Temporary shutdown

-

Financial stress

-

Restructuring

But that’s not true.

Company winding up means:

-

Business activities permanently stop

-

Assets are sold

-

Liabilities are paid

-

The remaining money is distributed

-

The company is legally dissolved

Once this is completed, the company no longer exists.

Its name is removed from the registrar’s records.

This is not a pause.

This is the final chapter.

Who Has the Power to Wind Up a Company?

Only the NCLT has this authority under Section 271.

Before passing any order, the Tribunal examines:

-

Financial condition

-

Conduct of directors

-

Compliance history

-

Interest of creditors

-

Public interest

The Tribunal does not act casually.

Winding up is ordered only when it is truly justified.

Circumstances in Which Company May Be Wound Up by Tribunal

Section 271 clearly mentions the circumstances in which a company may be wound up by a tribunal.

1. If the Company Is Unable to Pay Its Debts

This is the most common ground.

If the company is unable to pay its debts, the Tribunal may order winding up.

But this does not mean:

-

One missed EMI

-

Temporary cash shortage

-

A slow business month

It usually means:

-

Continuous defaults

-

Multiple creditor demands

-

No realistic repayment plan

-

Liabilities far exceeding assets

When recovery becomes impossible, continuing operations only harms creditors.

So, the law intervenes.

2. If the Company Passes a Special Resolution for Winding Up

Sometimes, the decision comes from inside the company.

If shareholders pass a special resolution stating that the company should be wound up by the Tribunal, Section 271 allows it.

This happens when:

-

Business has no future

-

The main object is over

-

Losses are permanent

-

Revival is unrealistic

Instead of letting the company remain abandoned, this provides a clean legal exit.

3. If the Company Is Involved in Fraud or Illegal Activities

This is one of the most serious grounds.

If a company:

-

Has carried out fraud

-

Was formed for illegal purposes

-

Operates against public interest

-

Is involved in unlawful activities

The Tribunal can order winding up immediately.

This is often seen in cases involving:

-

Shell companies

-

Ponzi schemes

-

Fake invoicing

-

Money laundering

Here, winding up is not just closure—it’s damage control.

4. Failure to File Returns for Five Consecutive Years

Many directors take filings lightly.

That’s a big mistake.

If a company fails to file financial statements or annual returns for five years, Section 271 allows winding up.

Why so strict?

Because long-term non-filing usually means:

-

The company is inactive

-

The company is misused

-

Directors are negligent

The law does not allow companies to exist without accountability.

5. When the Tribunal Finds It “Just and Equitable”

This is the most flexible ground.

The Tribunal can order winding up when it believes it is “just and equitable” to do so.

This may include:

-

Serious management deadlock

-

Oppression of minority shareholders

-

Loss of main business purpose

-

Continuous internal conflicts

This clause allows the court to deal with unfair situations that don’t fit neatly into other categories.

Section 271 vs Insolvency Under IBC

Many people confuse Section 271 with IBC proceedings.

But they are different.

-

IBC focuses on resolution first, liquidation later

-

Section 271 focuses directly on winding up when continuation makes no sense

When revival is not practical, Section 271 applies.

Who Can File a Winding-Up Petition?

A petition for winding up can be filed by:

-

The company

-

Any creditor

-

Any shareholder (contributory)

-

Registrar of Companies

-

Government authorities (in specific cases)

After receiving the petition, the Tribunal checks whether Section 271 conditions are satisfied.

Can a Winding-Up Petition Be Prevented?

Yes—and this is extremely important.

A petition for the winding up of a company can be prevented if the company can show that:

-

It can pay its debts

-

There is a genuine dispute

-

A settlement exists

-

A revival plan is realistic

-

The business is still viable

Courts usually prefer saving businesses rather than shutting them down—if saving is genuinely possible.

A Practical Real-Life Example

Imagine a company that:

-

Has no active operations

-

Has not filed returns for six years

-

Has unpaid taxes

-

Directors are unreachable

In such a case, the Registrar may approach the Tribunal.

And Section 271 becomes the legal tool to close the company properly.

Impact of Winding Up on Directors and Shareholders

Winding up does not automatically mean jail or punishment.

But:

-

Directors may be investigated

-

Fraud can lead to personal liability

-

Shareholders may lose investment

-

The company name is permanently removed

That’s why ignoring compliance is never harmless.

Common Misconceptions

“Loss-making companies are wound up.”

No. Loss alone is not enough.

“Small companies are safe.”

Wrong. Law applies to everyone.

“Tribunal orders winding up easily.”

No. The process is slow and cautious.

How Companies Can Avoid Section 271 Trouble

From real experience, these steps matter:

-

File returns regularly

-

Handle creditor issues early

-

Avoid opaque transactions

-

Resolve disputes legally

-

Seek professional advice on time

Most winding-up cases are preventable.

Final Thoughts on Section 271 of Companies Act 2013

To summarize:

-

Section 271 deals with compulsory winding up

-

It applies when a company should legally stop existing

-

NCLT has the authority

-

Grounds include debt default, fraud, non-compliance, and public interest

-

A winding-up petition can often be avoided with timely action

This section is not meant to scare business owners.

It exists to protect the business ecosystem.

A company is a legal privilege.

And every privilege comes with responsibility.

If your company is facing compliance stress, creditor pressure, or regulatory risk, early professional guidance can genuinely save it.

For practical assistance with company law compliance, NCLT matters, and preventive advisory, you can explore callmyca.com—because fixing issues early is always better than closing a company forever.