Section 463 Explained: Forgery Under IPC and Relief Under Companies Act

The moment people hear the word "forgery," they usually imagine fake signatures, false property papers, or fabricated documents. In real life, forgery cases are far more common—and far more serious—than most people realize. What makes it even more confusing is that section 463 exists in two different laws in India, and both mean completely different things.

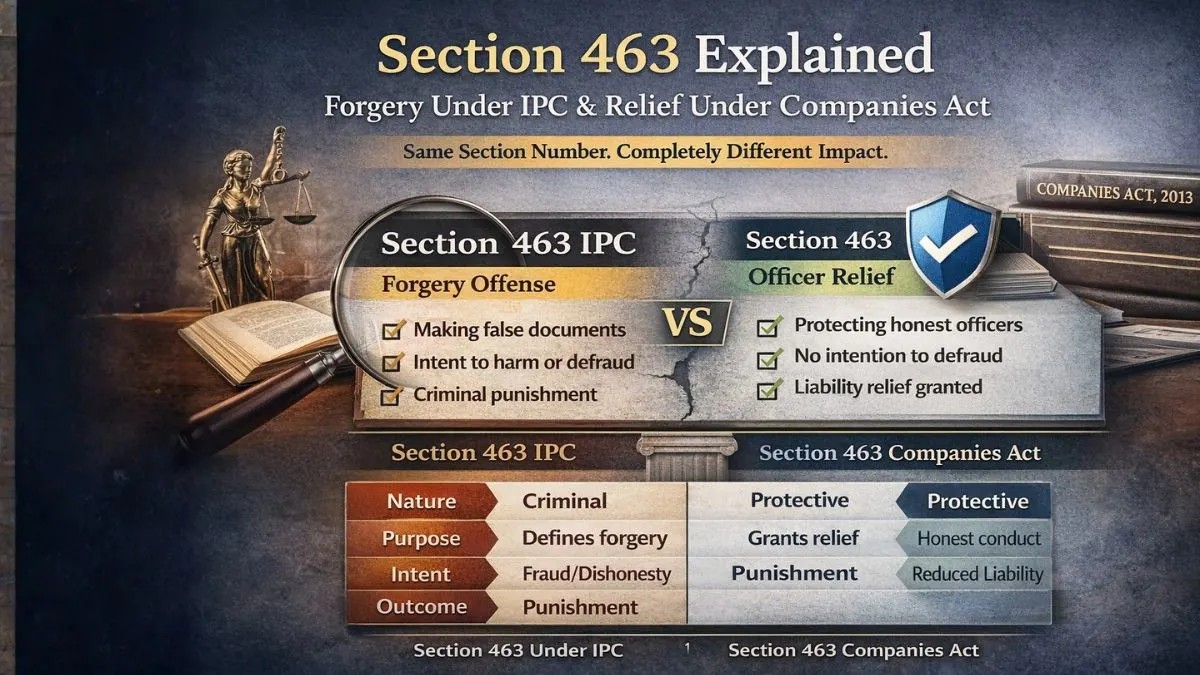

One section 463 deals with forgery under criminal law, while the other section 463 appears in corporate law and actually protects company officers in certain situations.

I’ve seen people panic just because they searched “section 463” online without knowing which law applies. So let’s clear this confusion properly, in simple, human language.

In this blog, we’ll understand:

- Section 463 under the Indian Penal Code (IPC)—what forgery really means

- Punishment, intent, and practical examples

- Whether IPC 463 is bailable or not

- How section 463 of Companies Act, 2013, is completely different

- Key differences you must know

Why Section 463 Causes So Much Confusion

The confusion exists because:

- Section 463 IPC talks about forgery (a criminal offense).

- Section 463 of Companies Act, 2013, talks about relief to company officers

Same section number. Totally opposite impact.

This blog explains both, clearly separated, so you never mix them up again.

Section 463 Under IPC—Meaning of Forgery

Let’s start with the criminal law side.

Under the Indian Penal Code, section 463 defines forgery.

In simple words:

Forgery means making a false document or electronic record with dishonest or fraudulent intention.

The law does not focus only on the document—it focuses on intention.

What Exactly Is Forgery Under Section 463 IPC?

According to section 463 IPC, a person commits forgery if they make a false document or record with the intent to:

- Cause damage or injury to the public or any person

- Support a false claim or title

- Cause someone to part with property

- Enter into a contract based on deception

- Commit fraud

So forgery is not just about fake documents. It’s about using falsity to gain unfair advantage or cause harm.

What Is a “False Document”?

This is where many people get trapped.

A document becomes “false” when:

- You sign someone else’s name without authority

- You alter a document dishonestly

- You create a document pretending it was made by someone else

- You backdate or modify records to mislead

Even emails, PDFs, digital signatures, and electronic records can fall under Section 463 IPC today.

Real-Life Examples of Forgery

To make it practical, here are common examples that attract section 463 IPC:

- Forged property sale deed

- Fake experience certificate

- Altered bank statements for loans

- False invoices to show higher expenses

- Fake signatures on agreements

- Manipulated company resolutions

In many cases, people don’t even realize they’ve crossed into forgery territory until a legal notice arrives.

Is Intention Important Under Section 463 IPC?

Yes. Intention is everything.

If there is no dishonest or fraudulent intention, Section 463 IPC may not apply.

But once intention is proved—through emails, conduct, or circumstantial evidence—the offense becomes serious.

This is why forgery cases are not taken lightly by courts.

Punishment Linked to Section 463 IPC

Here’s a critical point:

Section 463 IPC itself only defines forgery.

The punishment comes from other sections like

- Section 465 IPC – punishment for forgery

- Section 467 IPC – forgery of valuable security

- Section 468 IPC – forgery for cheating

- Section 471 IPC—using forged document

So section 463 is the foundation, and punishment depends on how serious the forgery is.

Is IPC 463 Bailable or Not?

A very common question people ask is

“Is IPC 463 bailable or not?”

Technically:

- Section 463 IPC is a definition section

- Bailability depends on the punishment section applied later

For example:

- Section 465 IPC—usually bailable

- Section 467 IPC—non-bailable and very serious

So bailability depends on the type of forgery, not just Section 463 alone.

Section 463 IPC in BNS (Bharatiya Nyaya Sanhit a)

With the introduction of the Bharatiya Nyaya Sanhita (BNS), provisions relating to forgery have been restructured, but the core concept of forgery remains the same.

The definition-based role played by section 463 IPC continues under the new criminal framework, even if section numbers change.

So the substance of forgery law remains intact.

IPC 463 and 464—How They Work Together

Many legal professionals read IPC 463 and 464 together.

- Section 463 IPC—defines forgery

- Section 464 IPC—explains what makes a document “false”

Together, they establish:

- What forgery is

- How false documents are created

This combination is crucial in criminal trials.

Section 463 of Companies Act, 2013—A Completely Different Law

Now comes the twist.

Section 463 of the Companies Act, 2013, has nothing to do with forgery.

In fact, it does the opposite of punishment.

What Is Section 463 of the Companies Act, 2013?

Under the Companies Act, Section 463 of the Companies Act, 2013, gives courts the power to grant relief to company officers.

In simple terms:

If a company officer acted honestly and reasonably, the court may relieve them from liability, even if there was technical non-compliance.

This provision exists to protect genuine directors and officers from harsh consequences when there is no fraud or mala fide intention.

When Can Relief Be Granted Under Companies Act Section 463?

Courts may grant relief when:

- The officer acted honestly

- There was no intention to defraud

- The mistake was procedural or technical

- The officer cooperated fully

This section recognizes that not every default deserves punishment.

Why Section 463 of Companies Act Is Important

Corporate law is complex. Even experienced directors can make mistakes.

Section 463 of the Companies Act, 2013, ensures:

- Honest professionals are not unfairly penalized.

- Courts can apply practical judgment

- Business decisions are not criminalised unnecessarily

This is why confusing this section with section 463 IPC can be dangerous.

Key Differences: Section 463 IPC vs Companies Act

|

Aspect |

Section 463 IPC |

Section 463 Companies Act |

|

Nature |

Criminal |

Protective |

|

Purpose |

Defines forgery |

Grants relief |

|

Intent |

Fraud/dishonesty |

Honest conduct |

|

Outcome |

Leads to punishment |

Reduces liability |

|

Law |

Indian Penal Code |

Companies Act, 2013 |

Same number. Opposite meaning.

Common Mistake People Make

Many people panic when they see “Section 463” in notices or searches.

First question you should always ask:

“Which act?”

Because:

- Section 463 IPC can lead to criminal prosecution

- Section 463 of the Companies Act can actually save you

Practical Advice If Section 463 Is Involved

If you’re dealing with section 463 IPC:

- Don’t ignore legal notices

- Preserve documents and digital evidence

- Take criminal law advice early

If section 463 of the Companies Act, 2013, applies:

- Document honest conduct

- Show lack of mala fide intent

- Approach court properly for relief

A wrong approach can worsen the situation.

Final Thoughts

Section 463 is one of those legal provisions where context is everything.

- Under IPC, it defines forgery, a serious criminal offense.

- Under Companies Act, it offers relief and protection

Understanding the difference can save you from unnecessary fear—or unnecessary trouble.

If you’re facing a situation involving section 463 IPC, IPC 463 and 464, or section 463 of the Companies Act, 2013, don’t rely on half-knowledge from random searches.

For expert legal and compliance guidance, visit callmyca.com—because the right interpretation of law can change the entire outcome.