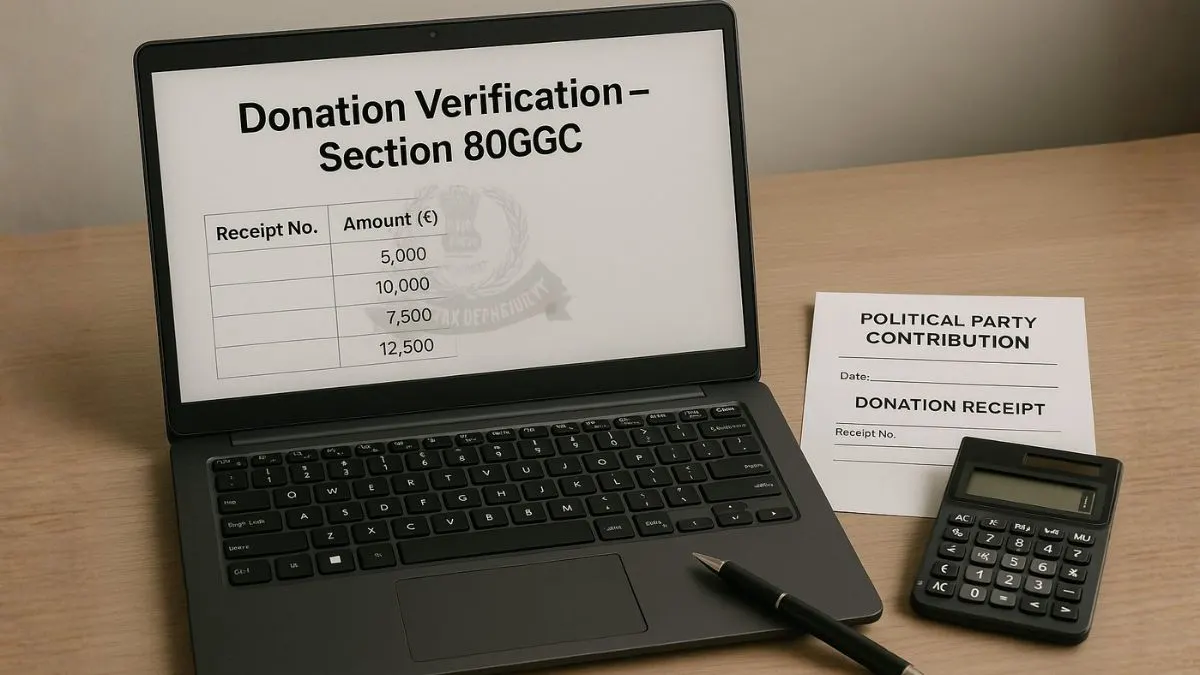

Recently, the Income Tax Department urged taxpayers to double-check their political donation claims under Section 80GGC before filing returns. The move came after officials noticed a spike in wrong or inflated claims — many from people who didn’t even donate to registered political parties.

The message was clear: verify your donation before you claim it. It’s not just about avoiding penalties; it’s about ensuring your return tells the real story.

Understanding Section 80GGC — What It Really Means

Section 80GGC isn’t new, but most taxpayers still misunderstand it. In simple terms, this section lets individuals and HUFs claim a 100 % deduction for genuine political donations — but only if the contribution is made through official, traceable channels.

You can’t donate in cash & expect a deduction. You also can’t fund an unregistered organisation and hope it counts. The donation must go to a political party registered under Section 29A of the Representation of the People Act or to a Government-approved electoral trust.

The idea behind it is to promote clean, transparent political funding — no black money, no paper receipts, no confusion.

Why This Verification Matters Now

During routine assessments, the department found hundreds of taxpayers claiming 80GGC deductions for contributions to groups that weren’t even recognised political parties. Some were NGOs, others were private associations, and a few didn’t exist at all.

So, instead of waiting for scrutiny letters later, the department decided to act early. The advisory now urges taxpayers to verify & update political donation claims right at the filing stage.

If you think about it, this actually helps everyone. Genuine taxpayers stay safe, and fraudsters get filtered out.

Who Can Claim Under Section 80GGC

Only individuals and HUFs can claim the deduction — not companies, partnerships, or trusts.

And to qualify:

- Donations must be made digitally — via cheque, bank transfer, or UPI.

- The recipient must be a registered political party or approved electoral trust.

- You must have a valid receipt that includes the party’s PAN, registration number, and transaction reference.

Anything short of this, and your claim can be rejected.

Also Read: Tax Deduction on Political Donations by Companies

When a Small Error Became a Big Lesson

Meet Riya, a salaried professional from Pune. Last year, she donated ₹ 25 000 to a local political group that campaigned during state elections. She proudly claimed it under Section 80GGC, assuming it was eligible. A few months later, Riya received a gentle e-mail from the department asking her to “verify donation details.” When she checked, she realised that the group wasn’t registered with the Election Commission. Her deduction was disallowed, and she had to revise her return.

“It wasn’t about the money,” she later said, “it was about learning how one small oversight can create unnecessary stress.”

Her case is exactly what this new verification advisory aims to prevent.

How to Verify Your Donation

If you’ve made political donations, take five minutes to verify them:

- Visit the official Income Tax e-filing portal.

- Log in → Filed Returns → Acknowledged ITR.

- Select the correct assessment year.

- Open the Deductions section & check your Section 80GGC entry."

- Match the details with your bank statement or UPI record.

- Verify the recipient’s registration status on the Election Commission of India (ECI) website.

If anything looks off, file a revised return under Section 139(5) before the deadline.

Make Sure the Organisation You Donated To Is Eligible

This part can’t be stressed enough. Donations to NGOs, crowd-funding campaigns, or local volunteer groups don’t qualify. The law only recognises:

- Political parties registered under Section 29A; and

- Electoral trusts approved by the CBDT.

To check, go to the ECI’s official site and confirm whether the party appears on the list of recognised entities. A two-minute search can save you months of back-and-forth with the tax department.

Common Mistakes Taxpayers Make

Even sincere donors slip up. Here’s what the department commonly finds:

- Claiming donations made in cash.

- Typing the wrong PAN or name of the party.

- Donating to an unregistered group.

- Not keeping the official receipt.

- Carrying forward the same donation into next year’s return.

Each of these can trigger an automated mismatch and result in an intimation under Section 143(1).

Also Read: Political Party Registration and Compliance

What Happens If Your Claim Is Wrong

If the department finds your claim invalid, it won’t just deny the deduction. The amount gets added back to your taxable income.

For example, if you wrongly claimed ₹ 30 000, your tax payable will increase accordingly — plus interest under Sections 234B & 234C. Repeated mistakes may even invite a penalty under Section 270A for under-reporting income.

In simple words: it’s better to fix an error voluntarily than to explain it later.

If You’ve Already Claimed Incorrectly

Don’t worry — the law gives you a second chance.

You can:

- File a revised ITR correcting the deduction.

- Attach or upload proper proofs.

- Mention the correct recipient details.

If your case has already been picked for review, respond through the e-proceedings section with supporting evidence. A clear explanation often settles the matter without penalties.

Transparency in Political Funding — The Bigger Picture

The whole purpose of Section 80GGC is to make political donations traceable. The government wants taxpayers to participate in democracy responsibly, not anonymously.

By moving everything online — from donations to verification — India is building a more transparent system. Each PAN-linked contribution can be tracked, reducing the chances of black-money funding.

So, when you verify your claim, you’re not just protecting yourself — you’re strengthening that system too.

Section 80GGC vs Section 80GGB

People often mix these up.

- Section 80GGC: for individuals & HUFs.

- Section 80GGB: for companies and business entities.

Both sections provide 100 % deduction, but you can’t use both simultaneously. Choose based on who the donor is.

Department’s Use of Technology

The verification drive is powered by AI-based matching. When you claim a donation, the system compares it with data from political parties’ reports filed with the Election Commission. If your PAN and amount don’t match, the system flags it automatically.

This is why accuracy is critical — every number must match exactly. The department doesn’t guess; it verifies through data.

Also Read: Received a Notice for Political Donations? Here's What You Must Know

If You Receive a Notice

A notice under Section 80GGC isn’t a disaster. It’s usually a soft reminder. Just:

- Upload the receipt issued by the party or trust.

- Provide bank proof of payment.

- Share acknowledgment details if available.

Respond within the given timeline. If you’re unsure what to attach, get help from your CA — a professional reply often closes the case immediately.

Documents You Should Keep Ready

Always store:

- Donation receipt with party’s PAN & registration number.

- Bank or UPI statement showing transaction.

- Screenshot of the ECI party listing."

- Copy of acknowledgment from the party (if provided).

Keeping digital backups is wise — notices sometimes arrive two or three years later.

A Quick Example of a Valid Claim

Let’s say Amit donates ₹ 20 000 via UPI to a recognised national party. He receives an e-receipt mentioning the party’s registration number and PAN. When filing his return, he attaches the details under Section 80GGC.

Result: 100 % deduction allowed.

Now, if Amit had donated ₹ 5 000 in cash to a local campaign office, that part wouldn’t qualify — even if it’s for the same party. The law values transparency over generosity.

Best Practices Before Filing

- Donate only through traceable modes.

- Check party eligibility on ECI’s website.

- Verify amount and PAN before claiming.

- Keep proofs for six years.

- Consult a CA if you’re unsure about eligibility.

Doing this once saves you multiple follow-ups later.

Why This Advisory Builds Trust

This verification step isn’t a crackdown; it’s a confidence-building measure. When honest taxpayers submit genuine claims, they’re helping build a cleaner financial ecosystem.

Think of it as the Income Tax Department saying, “Let’s keep things transparent — both for you & for the system.”

Also Read: Tax Benefits on Political Donations

Summary Table

|

Aspect |

Details |

|

Section |

80GGC of Income Tax Act |

|

Eligible Donors |

Individuals and HUFs |

|

Eligible Recipients |

Registered political parties / approved electoral trusts |

|

Payment Mode |

Cheque, bank transfer, UPI ( no cash ) |

|

Deduction |

100 % of donation amount |

|

Verification Needed |

Yes – ensure party is ECI registered |

|

Common Errors |

Cash donations, unregistered parties, wrong PAN |

|

Recent Advisory |

Income Tax Department urges taxpayers to verify & update political donation claims |

Conclusion

The Income Tax Department’s latest advisory on Section 80GGC is a reminder that good intentions alone aren’t enough — documentation matters. Before you claim, make sure the organisation you donated to is eligible for the deduction & your records match perfectly.

If you’ve already claimed incorrectly, fix it now. Transparency today saves explanations tomorrow.

And if you want a professional eye to review your ITR before submission, reach out to Callmyca.com — where expert CAs help you verify, file, and stay compliant without the stress.