Meta Title

TCS on Scrap Section Explained: Rate, Limit & Examples

Meta Description

TCS on scrap explained under Section 206C. Learn TCS rate, limit, applicability, examples, traders’ rules, and FY 2025–26 compliance in simple terms.

URL Slug

tcs-on-scrap-section-206c-explained

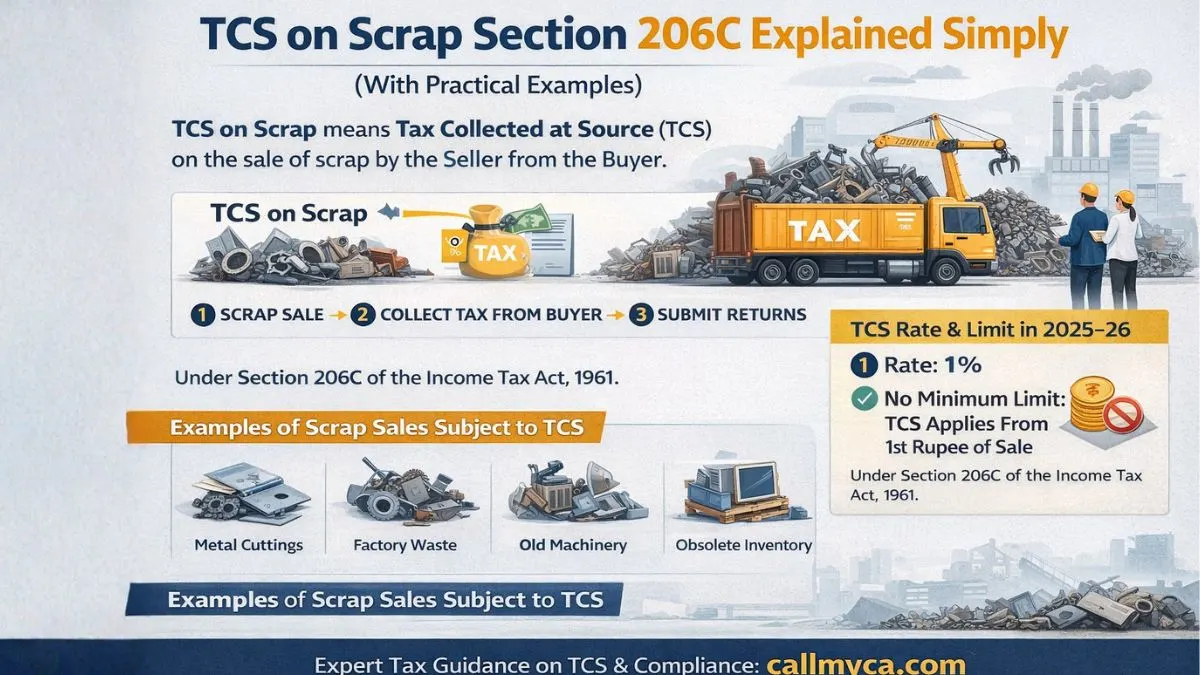

TCS on Scrap Section Explained Simply (With Practical Examples)

If you deal in metal scrap, factory waste, old machinery, or industrial leftovers, you have probably searched tcs on scrap section at some point — usually after your accountant asked, “Did you collect TCS?”

And that’s where confusion begins.

Is TCS always applicable on scrap?

Who should collect it — manufacturer or trader?

What is the rate?

What is the limit?

And what changes apply for FY 2025–26?

Let’s clear everything, slowly and practically, without complicated tax language.

What Is TCS on Scrap?

TCS on scrap means Tax Collected at Source on the sale of scrap by the seller from the buyer.

In simple words:

- When scrap is sold

- The seller must collect tax

- From the buyer

- And deposit it with the Income Tax Department

This system ensures tax compliance at the point of sale, instead of waiting for the buyer to declare income later.

TCS on Scrap Section – Which Law Applies?

The sale of scrap is governed by Section 206C of the Indian Income Tax Act, 1961.

Specifically:

- tcs on scrap section 6ce (commonly referred in practice)

- tcs on scrap sale section 206c(1)

This section deals with the collection of tax at source and makes it mandatory for sellers to collect tax on scrap sales under prescribed conditions.

What Is Considered “Scrap” for TCS Purposes?

This is very important.

Under tax law, scrap means:

- Waste and scrap from manufacturing

- Mechanical working

- Old, discarded materials

- Items not usable as such

Examples:

- Metal cuttings

- Factory waste

- Broken machinery parts

- Obsolete inventory sold as scrap

If the material is still usable as a product, it may not qualify as scrap.

TCS Rate on Scrap

One of the most searched questions is about rates.

👉 TCS rates are 1% on the sale of scrap

Key points:

- Rate: 1%

- Applied on sale value

- Collected by seller

- Paid by buyer

This rate applies unless the buyer provides a valid exemption certificate.

Sale of Scrap TCS Rate and Section (Quick Summary)

|

Particular |

Details |

|

Section |

Section 206C |

|

Nature |

TCS on scrap |

|

Rate |

1% |

|

Collected by |

Seller |

|

Paid by |

Buyer |

|

Applicable from |

First rupee (no threshold) |

Sale of Scrap TCS Limit – Is There Any Minimum?

A very common doubt is about sale of scrap tcs limit.

👉 There is NO minimum limit for TCS on scrap.

Even if:

- Scrap sale is ₹5,000

- Or ₹50,000

TCS must be collected.

This is different from some other TCS provisions where thresholds apply.

TCS on Scrap Sale With Example

Let’s understand this with a very practical tcs on scrap sale with example.

Example 1: Manufacturer Selling Scrap

- Scrap sale value: ₹1,00,000

- TCS rate: 1%

Calculation:

- TCS = ₹1,000

- Buyer pays = ₹1,01,000

- Seller deposits ₹1,000 as TCS

Example 2: Trader Selling Scrap

A scrap trader sells old iron scrap worth ₹2,50,000.

- TCS @ 1% = ₹2,500

- Buyer pays ₹2,52,500

Yes — tcs on scrap sale by traders also applies.

Who Is Required to Collect TCS on Scrap?

Under Section 206C:

- Any seller of scrap

- Including manufacturers

- Including traders

- Including dealers

If you are selling scrap as part of business, you must submit TCS under Section 206C.

Who Is Not Required to Collect TCS?

TCS may not apply if:

- Buyer gives Form 27C (for manufacturing use)

- Buyer is exempt category (Government, etc.)

- Scrap is not actually “scrap” as per definition

But exemptions must be documented properly.

TCS on Scrap Sale FY 2025–26 – What to Know

For tcs on scrap sale fy 2025-26, the rules remain unchanged:

- Rate continues at 1%

- Section continues as 206C

- Compliance requirements remain strict

- Filing deadlines remain the same

What has changed is scrutiny — tax authorities are now actively matching:

- GST data

- TCS returns

- Income disclosures

Difference Between TCS on Scrap and TCS on Sale of Goods

Many people confuse scrap with general goods.

Here’s a quick clarity:

|

Basis |

Scrap |

Sale of Goods |

|

Section |

206C |

206C(1H) |

|

Rate |

1% |

0.1% |

|

Threshold |

No limit |

₹50 lakh |

|

Nature |

Waste material |

Regular goods |

So tcs on sale of goods is different from scrap TCS.

What Is Section 206CQ TCS Section?

You might also see 206cq tcs section in searches.

Section 206CQ relates to:

- TCS on certain goods

- Higher compliance categories

However, scrap specifically falls under Section 206C(1), not 206CQ.

What If Buyer Does Not Have PAN?

If buyer fails to provide PAN:

- TCS rate increases

- Higher rate applies as per law

- Can go up to 5%

This often creates disputes, so PAN collection is critical.

TCS Compliance – What Sellers Must Do

If you sell scrap, you must:

- Collect TCS at time of sale

- Deposit TCS monthly

- File TCS returns (Form 27EQ)

- Issue TCS certificate (Form 27D)

- Maintain buyer records

Skipping any step can trigger penalties.

Penalty for Non-Collection or Non-Deposit of TCS

Failing to comply can lead to:

- Interest

- Penalty

- Disallowance issues

- Notices from tax department

Many scrap sellers face notices simply because they forgot to collect TCS.

Common Mistakes in Scrap TCS

From experience, these are the most common errors:

- Assuming TCS applies only above a limit

- Treating scrap like regular goods

- Ignoring trader-to-trader sales

- Missing TCS returns

- Not issuing certificates

Does GST Affect TCS on Scrap?

Yes, but indirectly.

- TCS is calculated on sale value excluding GST

- GST and TCS are separate compliances

- Both must be properly accounted

Mismatch between GST turnover and TCS data often triggers scrutiny.

Why TCS on Scrap Is Closely Monitored

Scrap business involves:

- Cash-intensive transactions

- High turnover

- Informal practices

So the government uses TCS as a tracking mechanism.

Practical Advice for Scrap Sellers

If you deal in scrap:

- Always treat TCS as mandatory

- Educate your billing team

- Automate accounting

- Reconcile TCS with GST

- File returns on time

Ignoring TCS today can become a big tax problem tomorrow.

Final Thoughts: Why Understanding TCS on Scrap Matters

TCS on scrap section is not just a technical tax rule. It is a serious compliance requirement under Section 206C of the Income Tax Act, 1961.

Understanding:

- Rate

- Section

- Applicability

- Limits

- Examples

can save you from penalties, notices, and unnecessary stress.

Need expert help with TCS, GST, or income tax compliance?

Visit callmyca.com for practical, no-nonsense guidance tailored for businesses, traders, and manufacturers.