Tax planning can feel overwhelming, especially when you’re juggling different investment options, insurance premiums, pension contributions, and saving schemes. Many people assume each section gives a separate deduction, but the truth is a bit more structured. Section 80CCE of the Income-tax Act acts like a cap that ensures the total deductions claimed under Section 80C, Section 80CCC, and Section 80CCD(1) stay within a certain limit.

This rule applies to both individuals and Hindu Undivided Families (HUFs) & helps maintain clarity around how much you can deduct in a financial year. Once you understand Section 80CCE, tax planning becomes far more predictable and stress-free.

What Is Section 80CCE?

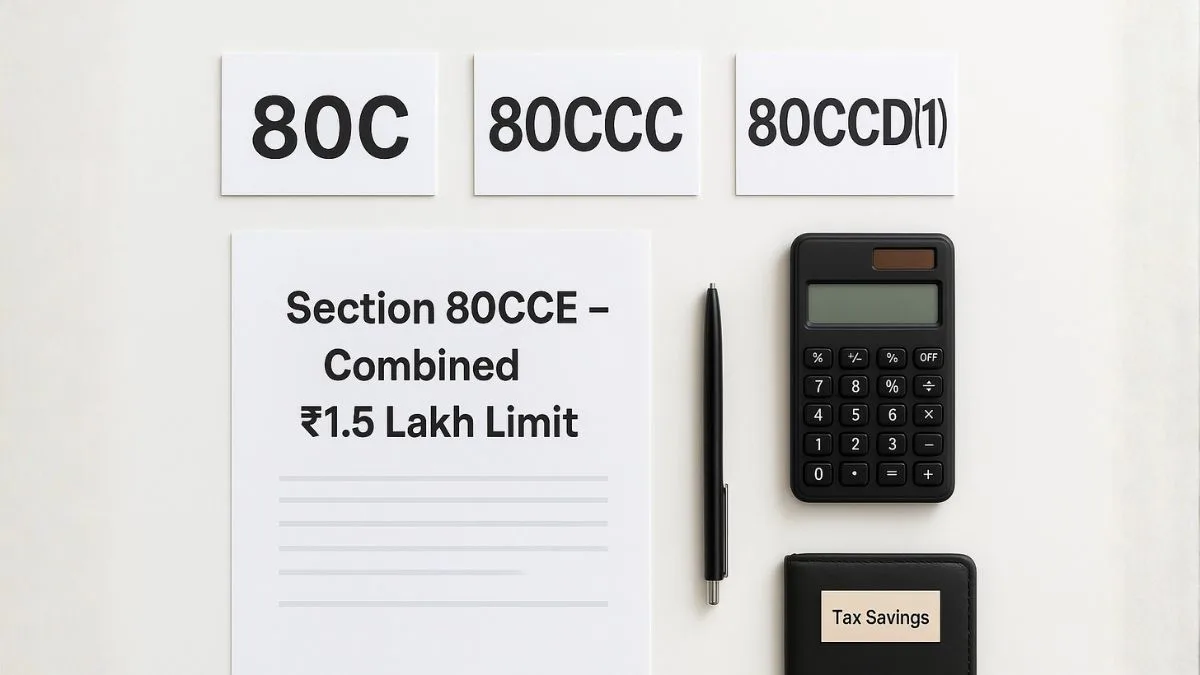

At its core, Section 80CCE is a provision that limits the aggregate amount of deductions a taxpayer can claim under:

- Section 80C – investments like ELSS, PPF, LIC premiums, repayment of home loan principal

- Section 80CCC – contributions to certain pension funds

- Section 80CCD(1) – the taxpayer’s own contribution to NPS/APY

The combined deduction allowed under these three sections cannot exceed ₹1.5 lakh in a financial year.

It doesn’t matter how many eligible investments you make—₹1.5 lakh is the maximum deduction under Section 80CCE.

Why Was Section 80CCE Introduced?

Before this provision, taxpayers were confused about whether deductions under 80C, 80CCC, & 80CCD(1) were independent. Some even assumed they could claim ₹1.5 lakh for each of them separately, which wasn’t the intention of the law.

Section 80CCE brings:

- Clarity — one combined limit

- Fairness — uniform treatment for all taxpayers

- Simplicity — easier tax planning and fewer disputes

Think of it as a ceiling that helps everyone stay within the same structure.

Also Read: An Exclusive Tax Benefit for NPS Subscribers

Who Can Claim Deduction Under Section 80CCE?

This section allows resident individuals and Hindu Undivided Families (HUFs) to claim deductions. It doesn't apply to companies or firms.

If you are:

- a salaried individual,

- a self-employed person, or"

- part of an HUF,

you can claim deductions on specific investments & contributions up to ₹1.5 lakh under this combined limit.

What All Falls Under Section 80CCE?

- Section 80C deductions

- Includes savings and investments such as:

- Life insurance premiums

- ELSS mutual funds

- PPF contributions

- NSC

- Sukanya Samriddhi Yojana

- Principal repayment on housing loan

- Includes savings and investments such as:

- Section 80CCC deductions

- Relates to contributions to pension plans offered by insurance companies.

- Section 80CCD(1) deductions

- Allows taxpayers to claim deductions for their personal contribution to NPS/APY.

Although many people don’t realise it, section 80CCE deduction in respect of contribution to pension also falls under this umbrella limit—meaning even your pension-related investments are counted within the ₹1.5 lakh ceiling.

Important Clarification: What Is NOT Included Under 80CCE?

One point people often miss is that Section 80CCD(1B) — the additional ₹50,000 NPS deduction — is NOT part of the 80CCE limit.

This means you can claim:

- ₹1.5 lakh under Section 80C 80CCC 80CCD(1) (combined limit under 80CCE)

- Plus an additional ₹50,000 under Section 80CCD(1B)

- Also, employer contributions under Section 80CCD(2) are separate

This structure allows disciplined savers to reduce their taxable income significantly.

Also Read: Valuation of Shares for Angel Tax and Income Tax Compliance

A Relatable Example

Imagine you invest:

- ₹1,20,000 in 80C

- ₹20,000 in a pension fund under 80CCC

- ₹30,000 in NPS under 80CCD(1)

Total = ₹1,70,000

But under Section 80CCE, your maximum claim is still ₹1.5 lakh. The remaining ₹20,000 won’t be allowed as deduction unless it qualifies under 80CCD(1B).

This example alone has saved many people from overestimating their tax benefits.

Why Section 80CCE Matters for Financial Planning

By setting out the overall deduction limit, Section 80CCE governs the combined limit for tax deductions & prevents misinterpretation. It also encourages thoughtful decisions about what to invest in, rather than blindly investing everywhere just for deductions.

It ensures:

- You don’t exceed your deductible limit

- You plan your investments more strategically

- You understand how pension contributions fit into the broader picture

For someone managing both long-term savings & tax liabilities, this rule becomes the backbone of planning.

Quick Summary

- Section 80CCE allows taxpayers to claim deductions up to ₹1.5 lakh for Section 80C, 80CCC, and 80CCD(1).

- It sets out the overall deduction limit, preventing overlap or duplication."

- Applies to resident individuals and HUFs.

- Additional ₹50,000 under 80CCD(1B) is separate & not restricted by 80CCE.

- Helps simplify tax planning across multiple sections.

Also Read: The Forgotten Tax Benefit for First-Time Investors (Rajiv Gandhi Equity Savings Scheme)

Conclusion

Section 80CCE may look small, but it plays a powerful role in shaping how millions of Indians plan their taxes each year. It sets boundaries, ensures fairness, and helps you use your tax-saving tools more wisely. Once you understand how this limit works, tax planning feels less like a puzzle & more like a guided path.

If you'd like someone to simplify your tax planning or guide you step-by-step, the experts at Callmyca.com are always ready to help.