Directors aren’t just names on paper. They are the minds and voices steering a company’s future. Section 152 of the Companies Act, 2013, lays down the foundation for how directors are appointed, how long they remain, and when they must step aside. It governs the appointment, tenure, and eligibility of directors in a way that protects shareholders while ensuring continuity in management.

In practice, I’ve seen startups overlook this section during incorporation, only to face governance issues later. Whether you’re setting up a private company or sitting on a public company board, understanding Section 152 saves you from compliance risks and leadership confusion.

What Section 152 of the Companies Act, 2013, Covers

At its core, Section 152 governs the appointment, qualifications, and retirement of directors. It sets out clear rules so that boards are not permanent power centers but accountable bodies answerable to shareholders.

This section:

- Defines who appoints directors

- Clarifies when shareholder approval is required

- Introduces retirement by rotation

- Provides exceptions for first directors

- Ties appointments to essential identifiers like DIN

Simply put, it ensures boards stay legitimate and transparent.

Appointment of Directors—The General Rule

Appointment Through General Meeting

As per Section 152, every director shall be appointed by the company in a general meeting, unless the articles of association say otherwise.

This rule exists for a reason:

- Shareholders are the true owners

- Directors manage on their behalf

- Approval must flow from ownership

In real terms, it prevents quiet backdoor appointments and ensures informed consent.

Who Can Be Appointed as a Director?

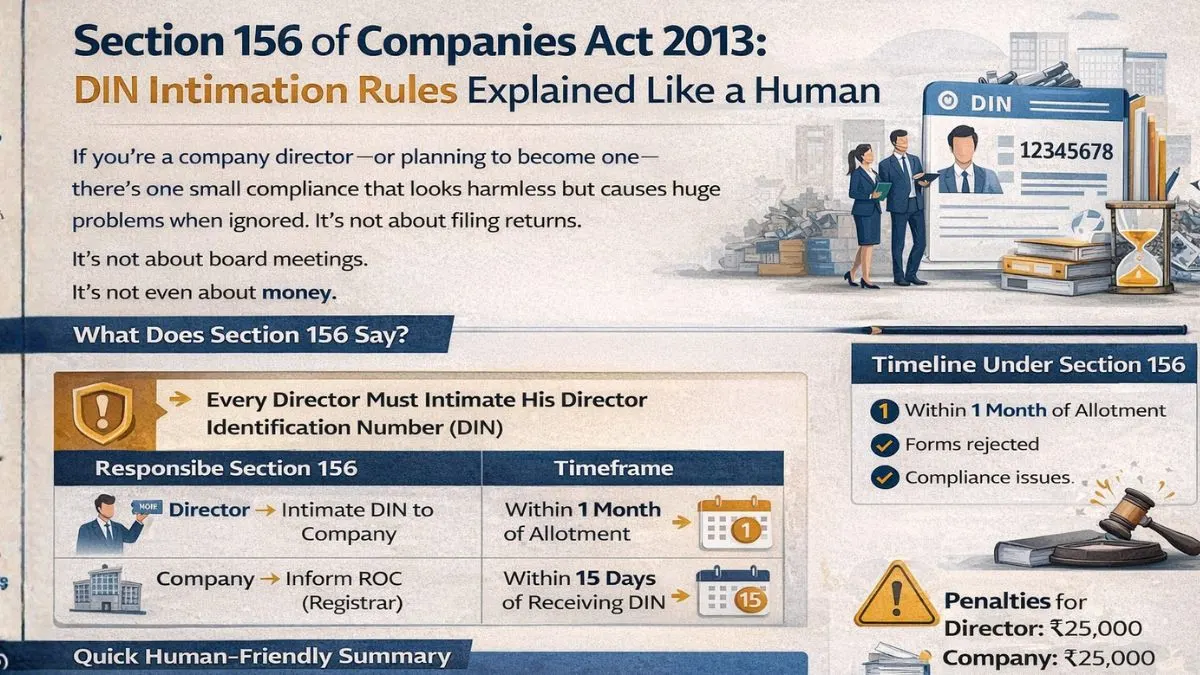

Director Identification Number (DIN) Is Mandatory

One of the most basic yet critical requirements is that no individual can be appointed as a director without a valid DIN.

This helps:

- Track directorships across companies

- Prevent impersonation

- Ensure regulatory oversight

If you’ve ever helped someone apply for DIN, you’ll know it’s the first real checkpoint in governance.

First Directors—A Practical Exception

Section 152 recognizes that newly formed companies need flexibility.

If the articles of association name the first directors, those individuals become directors automatically on incorporation.

If not, the subscribers to the memorandum become the first directors until proper appointments are made.

This avoids delays and ensures a company can function immediately after incorporation.

Appointment by Articles or Board (Limited Situations)

While every director shall be appointed by the company in a general meeting, Section 152 allows some flexibility if the articles permit:

- Appointment of additional directors

- Appointment of nominee directors

- Casual vacancy appointments

However, these are temporary in nature and usually require later shareholder ratification.

Retirement by Rotation—The Most Powerful Concept

What Is Retirement by Rotation?

This is where Section 152 truly shines in protecting shareholders.

In a public company:

- At least two-thirds of directors must be rotational directors

- One-third of these directors retire at every AGM

- Retiring directors are eligible for reappointment

This ensures:

- No director holds power indefinitely

- Shareholders regularly review board performance

- Governance stays dynamic

This rule is why Section 152 is often described as the backbone of board accountability.

Companies Where Rotation Does Not Apply

Retirement by rotation generally does not apply to:

- Private companies (unless articles provide)

- Independent directors

- Nominee directors

This balance allows flexibility without diluting oversight where it matters most.

Reappointment of Directors

Reappointment is not automatic.

If:

- A director retires by rotation

- And is not expressly reappointed

- And no resolution is passed

Then the position may become vacant.

Section 152 clearly outlines the detailed provisions concerning the appointment, retirement, and reappointment of directors, so there’s no ambiguity.

Tenure and Eligibility Under Section 152

While Section 152 governs appointment and retirement mechanics, it indirectly connects with:

- Disqualification provisions

- Maximum directorship limits

- Role-based requirements

Together, these rules ensure that only eligible and fit individuals hold board positions.

Why Section 152 Matters in Real Life

I’ve seen disputes arise not because of bad intent, but because companies:

- Missed AGM deadlines

- Failed to rotate directors

- Continued directorship without approval

All of this leads back to one section—Section 152.

It governs the appointment, tenure, and eligibility of directors in a way that keeps governance clean and defensible.

Common Mistakes Companies Make

- Appointing directors without valid DIN

- Forgetting shareholder approval

- Ignoring retirement by rotation in public companies

- Assuming first directors remain permanent

These errors can invalidate decisions taken by the board—a risk no company should take lightly.

Practical Insight from Experience

Good directors don’t fear rotation.

Bad governance does.

Section 152 isn’t restrictive—it’s protective. When followed properly, it builds credibility with investors, regulators, and lenders alike.

Conclusion

Section 152 of the Companies Act, 2013, quietly shapes how leadership is formed, reviewed, and renewed in Indian companies. By governing the appointment, qualifications, and retirement of directors, it ensures accountability without compromising continuity.

Whether you’re incorporating a company or managing an existing board, respecting Section 152 is non-negotiable for strong governance.

👉 If you need help with director appointments, DIN compliance, or board restructuring, connect with experts at callmyca.com and stay fully compliant.