Whenever a search takes place, it usually means the tax department has found something unusual — income or transactions that weren’t declared earlier. Once those documents, assets, or digital records come into light, the next question is how to tax them correctly. That’s where Section 158BC comes in.

This provision doesn’t just help officers collect taxes; it sets a framework for doing it in a structured, time-bound, and fair manner. It is part of what’s known as block assessment, a system created to deal with undisclosed income detected in search cases without reopening several years of returns separately.

What Exactly Is a Block Assessment?

Think of a block assessment as a summary proceeding. Instead of checking one financial year at a time, the department assesses income for a block of years — generally ten years prior to the date of the search. Here, the focus isn’t on regular income you’ve already reported. It’s only about undisclosed income that came to light because of the search. This could include cash transactions, unrecorded sales, or property deals that were missing from earlier filings.

The entire procedure is codified under Section 158BC, ensuring both clarity & consistency.

Why Section 158BC Was Introduced

Before this section existed, officers had to reopen every assessment year in which hidden income was suspected. This meant multiple notices, hearings, and years of litigation. The system was cumbersome for both sides. To simplify things, Chapter XIV-B was added to the Income Tax Act in 1995, introducing a single-window assessment process for search cases. Among these, Section 158BC became the core — defining how the officer should issue notices, call for returns, and finalise assessments.

It made post-search taxation faster, more transparent, & less intrusive.

The Step-by-Step Process under Section 158BC

- Beginning of Proceedings

Everything starts with a search under Section 132 or requisition under Section 132A. Once the search is complete & records are transferred, the jurisdictional officer steps in.

- Serving of Notice

The next move is procedural but crucial — the Assessing Officer is to serve a notice requiring the taxpayer to file a return for the entire block period. This notice works much like one under Section 142(1), except it’s specific to search assessments.

- Filing of Return

The taxpayer files a special return declaring the undisclosed income detected during the search. Supporting documents or reconciliations are attached wherever possible."

Also Read: Guide to Inquiry Notices and Compliance

- Examination and Verification

The officer examines seized material, bank records, & statements. Additional summons or clarifications can be issued to verify facts.

- Final Assessment Order

After cross-checking all data, the Assessing Officer finalises the block assessment — computing tax, surcharge, and interest under Section 158BFA. The order is served to the taxpayer.

Timelines and Validity

The law is very specific about time limits. A block assessment must be completed within two years from the end of the month in which the last search authorization was executed. Missing this deadline renders the entire proceeding invalid.

This time-bound structure ensures that cases don’t drag on endlessly & taxpayers get closure.

Scope and Applicability

Section 158BC applies strictly to cases where the search or requisition has taken place. It does not cover regular scrutiny, voluntary disclosures, or reassessments. The focus remains only on undisclosed income discovered during the search.

It essentially bridges the gap between what was hidden & what’s now found — ensuring that every rupee of income is assessed lawfully.

Illustration

Let’s take a simple example.

Suppose a search is carried out in July 2024 at a builder’s premises. The team finds records of unreported transactions from 2015 onwards. Instead of reopening ten years’ worth of returns, the officer issues a single notice under Section 158BC, asking for a return for the block period 2015–2024.

All undisclosed income is assessed in one go. It’s efficient, clear, & saves months of procedural work.

Key Differences Between Normal and Block Assessment

|

Particulars |

Regular Assessment |

Block Assessment |

|

Initiated by |

Filing of return |

Search or requisition |

|

Period Covered |

One financial year |

10 years before search |

|

Focus Area |

Total income |

Undisclosed income |

|

Applicable Section |

143, 147 |

158BC |

|

Timeline |

Variable |

Fixed — 2 years |

This makes block assessment a specialised process—narrow in scope, but strong in enforcement.

Also Read: Time Limits and Extensions for Special Audit Reports

Rights and Safeguards for Taxpayers

Even though Section 158BC gives wide powers to the Assessing Officer, taxpayers aren’t left unprotected.

They have the right to:

- Receive a valid notice before assessment.

- Know the basis of undisclosed income computation.

- Seek personal hearings and clarification opportunities.

- Appeal against the order before the Commissioner (Appeals) & further to the ITAT.

Courts have consistently held that failure to issue a proper notice invalidates the entire assessment, reinforcing the importance of due process.

Judicial Interpretations

Several landmark judgments have shaped how Section 158BC is applied."

For instance, in Manish Maheshwari v. CIT (2007), the Supreme Court ruled that a valid notice under Section 158BC is mandatory before assessment. In another case, CIT v. S. Ajit Kumar (2015), it was clarified that undisclosed income must be based on credible evidence found during search, not on assumptions.

These rulings underline the principle that power must always be exercised with accountability.

Connection with Section 153A

Post-2003, the government replaced the block assessment mechanism with Section 153A to streamline the process. However, the spirit of Section 158BC continues — the same logic, timelines, & procedural fairness now exist under the new regime.

In other words, Section 158BC walked so that 153A could run.

Challenges in Real Scenarios

In practice, many disputes arise around what qualifies as “undisclosed income.”

Sometimes, the seized records are incomplete or belong partly to other entities. At other times, valuation or ownership itself becomes a grey area. For businesses dealing largely in cash, proving disclosure can also get tricky.

This is why documentation & professional representation play a crucial role in defending one’s position during such assessments.

Also Read: Powers of Search and Seizure

Key Takeaways

- Section 158BC provides the procedure for block assessment following a search or requisition.

- The Assessing Officer is to serve a notice requiring the taxpayer to file a return for the block period.

- It focuses purely on undisclosed income discovered during search proceedings.

- Assessments must be completed within two years, ensuring time-bound action.

- Even though replaced by newer provisions, its principles remain relevant in tax law today.

Conclusion

Section 158BC of the Income Tax Act is a powerful but balanced piece of legislation. It ensures that income found during a search is taxed lawfully — neither ignored nor overreached. By combining strong enforcement with procedural fairness, it remains one of the most practical frameworks in tax administration history.

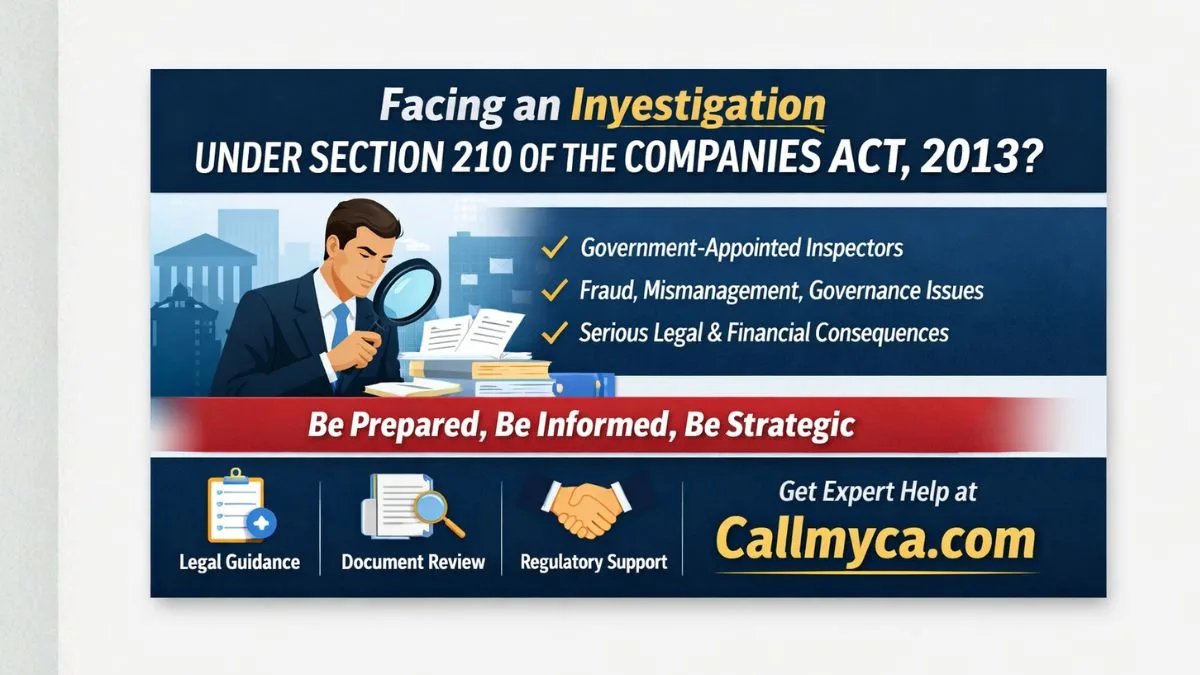

If you’ve received a notice or need help preparing for a search-related assessment, visit CallMyCA.com. Our CA experts can guide you through documentation, replies, and compliance — ensuring peace of mind & accurate filing.