Healthcare costs in India are often a burden for patients and families. Medicines, medical devices, and hospital consumables form a large part of treatment expenses. In its latest session, the GST Council meeting highlights revealed a major decision—cutting GST on several essential drugs and medical devices.

The reduction of GST on all other drugs and medicines from 12% to 5% is expected to ease the financial stress on patients. Experts from the healthcare industry welcomed the move, stating that the GST cut on drugs, medical devices will provide relief to patients and make treatments more affordable across hospitals and clinics.

GST Cut on Drugs and Medicines

One of the most impactful decisions is the reduction of GST on all other drugs and medicines from 12% to 5%. This directly lowers the cost of commonly prescribed drugs, benefitting patients suffering from chronic illnesses like diabetes, hypertension, and respiratory issues.

Medicines form a recurring expense for most households. Even a small reduction in GST has a ripple effect, lowering out-of-pocket expenditure and making long-term treatments more affordable. Patients, doctors, and hospitals all agree this is a step in the right direction.

Relief Through Lower GST on Medical Devices

The GST cut on drugs, medical devices will provide relief to patients who depend on life-saving tools and hospital care. The Council decided that the GST has been reduced from 12 per cent to 5 per cent on key medical products such as anaesthetics, medical-grade oxygen, gauze, and bandages.

These items are used in almost every hospital procedure, from surgeries to regular treatments. Reducing GST not only makes treatments cheaper but also helps hospitals manage costs better, which in turn benefits patients through reduced bills.

Specific Products That Will See Price Cuts

Patients and hospitals will notice price drops in several critical products, including:

- Anaesthetics – Essential for surgeries.

- Medical-grade oxygen – Widely used in ICUs and emergency care.

- Gauze and bandages – Everyday hospital consumables.

- Other diagnostic and supportive medicines.

By lowering GST on these products from 12% to 5%, the Council ensures that both emergency and routine care becomes less costly for families.

Also Read: New GST Rates on All Cars: From Alto to Mahindra Thar and Tata Nexon

Industry Reaction: Welcoming the Move

The healthcare sector has long argued for lower GST on essential items. With this decision, the government has finally responded. Industry leaders state that the GST cut on drugs, medical devices will provide relief to patients and reduce the overall cost of healthcare delivery.

Hospitals and pharmacies are expected to pass on the benefits directly to patients. Moreover, healthcare professionals believe this will encourage better compliance with treatments since affordability is often a barrier.

How Patients Will Benefit

For patients, this decision translates into:

- Lower medicine bills – Regular purchases become more affordable.

- Reduced hospital expenses – Consumables like gauze, bandages, and oxygen will cost less.

- Better access to treatment – More families can afford surgeries and long-term therapies.

- Financial relief in emergencies – Critical care products such as anaesthetics and oxygen will no longer carry heavy GST burdens.

This move helps not only individuals but also strengthens India’s public healthcare ecosystem.

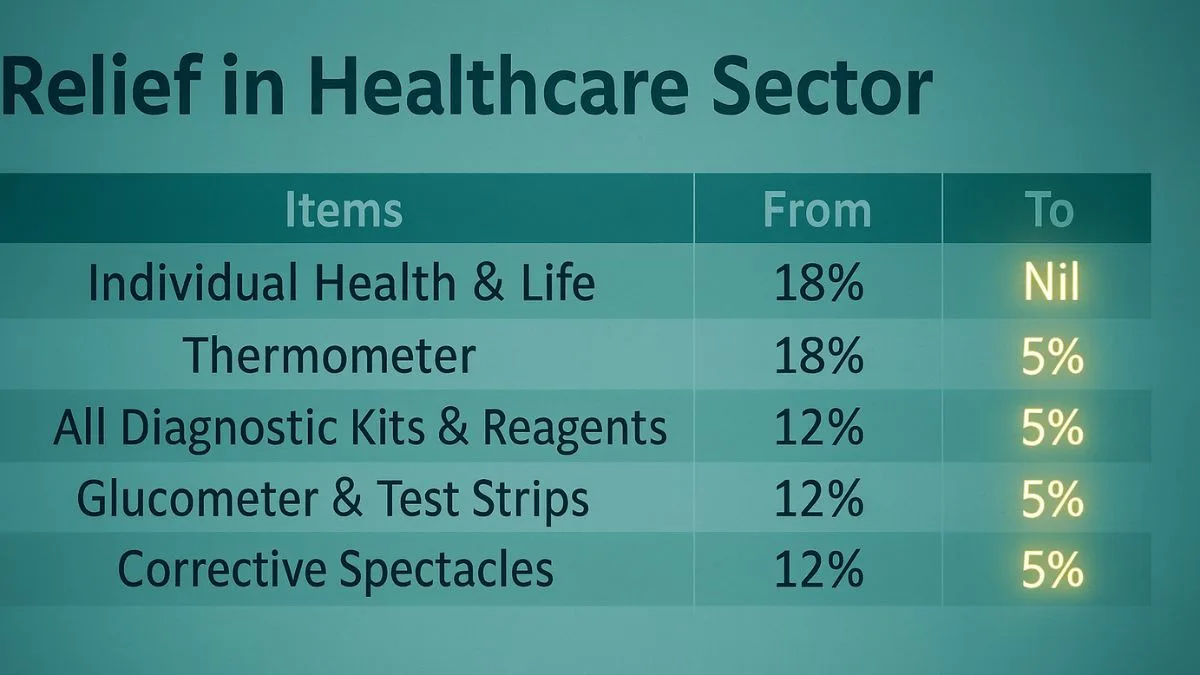

Comparison of Old vs. New GST Rates

|

Product/Category |

Old GST Rate |

New GST Rate |

Impact |

|

Drugs & Medicines |

12% |

5% |

Cheaper long-term treatments |

|

Anaesthetics |

12% |

5% |

Lower surgical costs |

|

Medical-Grade Oxygen |

12% |

5% |

Relief in emergency care |

|

Gauze & Bandages |

12% |

5% |

Everyday hospital costs reduced |

This table highlights how the Council’s decisions will touch almost every patient in India.

Why the Government Made the Cut

The decision to cut GST is both economic and humanitarian:

- To ease financial pressure on households already struggling with rising medical inflation.

- To ensure hospitals can lower treatment costs, especially in public healthcare setups.

- To strengthen India’s healthcare system post-pandemic, where affordability is a major concern.

- To balance industry growth with patient welfare by making essential products more accessible.

Wider Implications for the Healthcare Sector

The impact of this move goes beyond patients. Hospitals, clinics, and pharmaceutical companies will also benefit:

- Hospitals can provide packages at reduced costs.

- Pharmacies will see increased compliance as patients are more likely to purchase prescribed medicines.

- Pharma companies may experience a rise in demand due to affordability.

The decision strengthens the entire healthcare chain, making it more sustainable in the long run.

Healthcare Industry Speaks

Healthcare associations across India praised the move. They believe the reduction in GST rates will:

- Improve access to critical treatments in rural and semi-urban areas.

- Encourage early diagnosis and better treatment compliance.

- Boost trust between patients and the healthcare system.

The consensus is clear: GST cut on drugs, medical devices will provide relief to patients and transform how India manages healthcare affordability.

Final Thoughts

The latest GST Council meeting highlights mark a turning point for healthcare affordability in India. By announcing the reduction of GST on all other drugs and medicines from 12% to 5%, and reducing GST on anaesthetics, medical-grade oxygen, gauze, and bandages, the government has provided meaningful relief.

The GST cut on drugs, medical devices will provide relief to patients immediately, reducing both hospital and household expenses. For families struggling with healthcare costs, this decision is not just a financial change but a lifeline.